The Korean market and Korean stocks are suddenly hot; but its not just due to the AI bubble:

🇰🇷 Korean Stock Market – The Best Performing Among Major Countries Indices in 2025 (Douglas Research Insights) $ Dec 31, 2025

We discuss the five most important factors driving the Korean stock market this year which was the best performing among all major country equity markets in the world in 2025.

These five factors included the global AI boom, wars and rumors of wars, beneficiaries of MASGA, Korea Value-Up initiatives, and reduced political uncertainties with new President elected in June 2025.

Our best bet to diversify one’s portfolio and be more cautious because staying alive will be a key in 2026 rather than FOMO, especially in 2H 2026.

📰 FSC Allows Korean Securities Trading Account Opening For IBKR and 3 Other Foreign Firms (Douglas Research Insights) $ Jan 10, 2026

On 9 January, FSC announced that it will allow Korean securities account opening for IBKR and three other foreign firms including Emperor Securities, TFI, and BancTrust.

FSC announced that overseas traders will be able to access the Korean won on a 24 hours real-time exchange rates basis from July 2026.

KOSPI is up 82% in the past one year and the likelihood of Korea becoming Developed Market status is a key factor driving higher share prices of Korean stocks.

📰 KOSDAQ in on Fire! Korean Government Encourages Investment in KOSDAQ Companies by Pension Funds (Douglas Research Insights) $ Jan 29, 2026

KOSDAQ has been on fire in the past week. KOSDAQ is up 20% in the past one week, outperforming KOSPI which is up 5.4% in the same period.

One of the key reasons why KOSDAQ has been on fire is mainly due to expectation of the Korean government encouraging capital inflow into the KOSDAQ listed companies.

Korean government will encourage investment in the KOSDAQ by incorporating the KOSDAQ index into the evaluation criteria for the management of pension funds’ assets, which amount to 1,400 trillion won.

📰 KOSDAQ’s 7% Rise Today – A Fake Reversal or Sustainable by a Potential 17 Trillion Won Inflow? (Douglas Research Insights) $ Jan 26, 2026

The KOSDAQ index rose by 7.1% today to 1,064.4 today which was one of the largest single day returns for KOSDAQ in the past three decades.

Will this 7% upside move be a fake reversal or the start of a strong, sustainable momentum trade driven by a potential 17 trillion won inflow into the KOSDAQ companies?

The Korean government is trying to encourage the injection of nearly 17 trillion won into KOSDAQ listed companies through venture capital (raised through integrated market assets (IMAs) and commercial papers).

Some Korean ETF updates:

📰 Korea ETF Market Monthly: #1 (January 2026) (Douglas Research Insights) $ Feb 02, 2026

We introduce a new monthly publication called Korea ETF Market Monthly. There are 1,068 different ETFs to choose from in Korea.

The top 100 ETFs in Korea totaled 69% of the total ETF market size amount as of 30 January 2026.

Korean ETF market surged in the past two years. ETFs in Korea had total market cap of 346.5 trillion won (end of January 2026), up 179% in two years.

📰 Hanwha Asset Mgmt Launching the PLUS Korea Manufacturing Core Alliance Index ETF (KMCA) On NYSE (Douglas Research Insights) $ Feb 04, 2026

Hanwha Asset Management has launched the process of listing the PLUS Korea Manufacturing Core Alliance (KMCA) Index ETF on the NYSE in 1H 2026.

KMCA ETF will includes companies in six core sectors: 1) AI semiconductors, 2) batteries, 3) shipbuilding, 4), defense, 5) power grids and nuclear energy, and 6) robots and humanoids.

This is likely to attract additional foreign capital into Korean stocks in the coming months.

For tech investors, this is worth considering:

📰 ‘South Korea’s Google’ pitches AI alternative to US and China (FT) $ 🗃️ 11 Jan 2026

NAVER (KRX: 035420 / OTCMKTS: NHNCF) targets countries reluctant to use American and Chinese cloud systems out of security concerns

Naver, the search engine group often called “South Korea’s Google”, is pitching its cloud services to countries in the Middle East and south-east Asia as an alternative AI option to US and Chinese technology giants.

Finally, I have enough frequent flyer miles on China Airlines to visit Korea for a few weeks – I am thinking (depending on FF restrictions) late April-May would be a good time with flowers in bloom and the weather being not to hot or cold. Unlike with China/Japan, I honestly don’t know much about what there is to see in Korea (aside from the usual guidebooks/YouTube videos, I will play around with using Manus and some other Chinese AI providers – not sure if they might be useful for planning a trip specifically to Korea). I do love Korean food…

These places (so far) stand out:

Seoul – obviously… Although I suppose there is enough in the city and surrounding area to just stay there for a first time visit to Korea…

Busan – as it looks like a very scenic city…

Suncheon – at the bottom of the peninsula as it contains the Suncheonman Bay National Garden (which looks huge) & Suncheon-man Bay Wetlands

I spent 2 weeks in Kyoto and could have spent a month there visiting temple gardens and other scenic or uniquely Japanese sites. Seoul region aside, I am not sure if Korea has a city that’s similar with a huge concentration of sites.

However, I am not keen on visiting Jeju Island on a first time visit to Korea since that would involve either an extra flight or ferry ride…

Korean stocks from a variety of research sources covered in the rest of this post for January (but with up-to-date charts and key data – previous Korean stock posts are here):

[Note: On desktop browsers, an autogenerated table of contents will appear on the left side linked to each stock. I will add those links below after publishing/emailing this post…]

POSCO Holdings, Hyundai Glovis, POSCO International, Hyundai Motor, LG Chem, Samsung Electronics, Kumho Petrochemical, SK Hynix, Samsung C&T, Hyundai Mobis, SK Innovation, Kia Corp, Hanssem, S-Oil, Chunbo, LigaChem Biosciences, Cosmax, Samsung E&A, Krafton, Samsung Electro-Mechanics, Doosan Fuel Cell, LX Hausys, Daewoo Engineering & Construction Co Ltd, Jin Air, LG Electronics, LG Innotek, HD Hyundai Heavy Industries, Amorepacific Corp, DB Insurance, Hyundai Marine & Fire, Korean Reinsurance Company, APR, DL E&C Co Ltd, Samsung SDI, HL Mando, Korean Air, GS Engineering & Construction Corp, GC Biopharma, Samsung Heavy Industries, Hyundai Engineering & Construction, LG Uplus, KT, SK Telecom, Hyundai Steel, OCI Holdings, Hugel, CJ Logistics, Celltrion, LG Energy Solution & L&F

Readers can decide whether these DeepSeek insights or summary about these stocks are accurate:

🤖 DeepSeek Analysis

For AI & Semiconductor Investors (Growth/Momentum)

For Value & Income Investors (Dividends & Undervaluation)

For Thematic Investors (Robotics, Nuclear, & Defense)

For “Korea Discount” Play & Policy Beneficiaries

For Recovery & Turnaround Investors

Summary

Our Japan, Korea & Taiwan Stock Index is also up to 297 stocks (most are tagged) with more Korean stocks covered in out Sunday and Monday posts.

And as always, this post is provided for informational purposes only (and to make your life easier…). It does not constitute investment advice and/or a recommendation…

🔬 Research analysis (including articles/blog posts from fund managers, etc.); 🎥 Video; 🎙️ Podcast; 🎬 Webinar; 📰 Newspaper/magazine article; 📯 Press release; 💻 Substack/blog/website article; ✅ Our own posts; 🗃️ Archived article; ⏰ Upcoming webinar or event; ⚠️ Disclosures or restricted access e.g. based on your location, investor status, etc.; 🇼 Wikipedia page; 🏷️ Tagged links to other posts about the stock.

🔬 POSCO Holdings (005490 KS/Buy) – Weak 4Q results, but rebound expected in 2026 (Mirae Asset Securities) 01.30.2026 ⚠️

🔬 POSCO Holdings (005490 KS/Buy) – Lower expectations for 4Q25; earnings likely to normalize in 2026 (Mirae Asset Securities) 01.13.2026 ⚠️

🌐 POSCO Holdings (NYSE: PKX) – Integrated steel producer. 6 segments: Steel, Trading, Construction, Logistics & Others, Green Materials & Energy & Others. 🇼 🏷️

Price/Book (Current): 0.52

Trailing P/E: 46.72 (no forward P/E) / Forward Annual Dividend Yield: 2.73% (Yahoo! Finance)

🔬 Hyundai Glovis (086280 KS/Buy) – A growing list of premium factors (Mirae Asset Securities) 01.30.2026 ⚠️

🔬 Hyundai Glovis (086280 KS/Buy) – Entering a premium valuation phase (Mirae Asset Securities) 01.12.2026 ⚠️

🌐 Hyundai Glovis (KRX: 086280) – Global total logistics & distribution leader in Korea & internationally. Ocean transportation logistics advice, cargo space, loading/unloading & packaging services. 🇼 🏷️

Price/Book (Current): 1.95

Forward P/E: 10.21 / Forward Annual Dividend Yield: 2.27% (Yahoo! Finance)

🔬 POSCO International (047050 KS/Buy) – Growth momentum to be sustained (Mirae Asset Securities) 01.30.2026 ⚠️

🔬 Hyundai Motor (005380 KS/Buy) – Look beyond earnings concerns to robotics/autonomous driving momentum (Mirae Asset Securities) 01.30.2026 ⚠️

🔬 Hyundai Motor (005380 KS/Buy) – Earnings set to improve in 2026; beneficiary of robotics/SDV/robotaxi themes (Mirae Asset Securities) 01.19.2026 ⚠️

🔬 LG Chem (051910 KS/Buy) – 2026 still looks challenging (Mirae Asset Securities) 01.30.2026 ⚠️

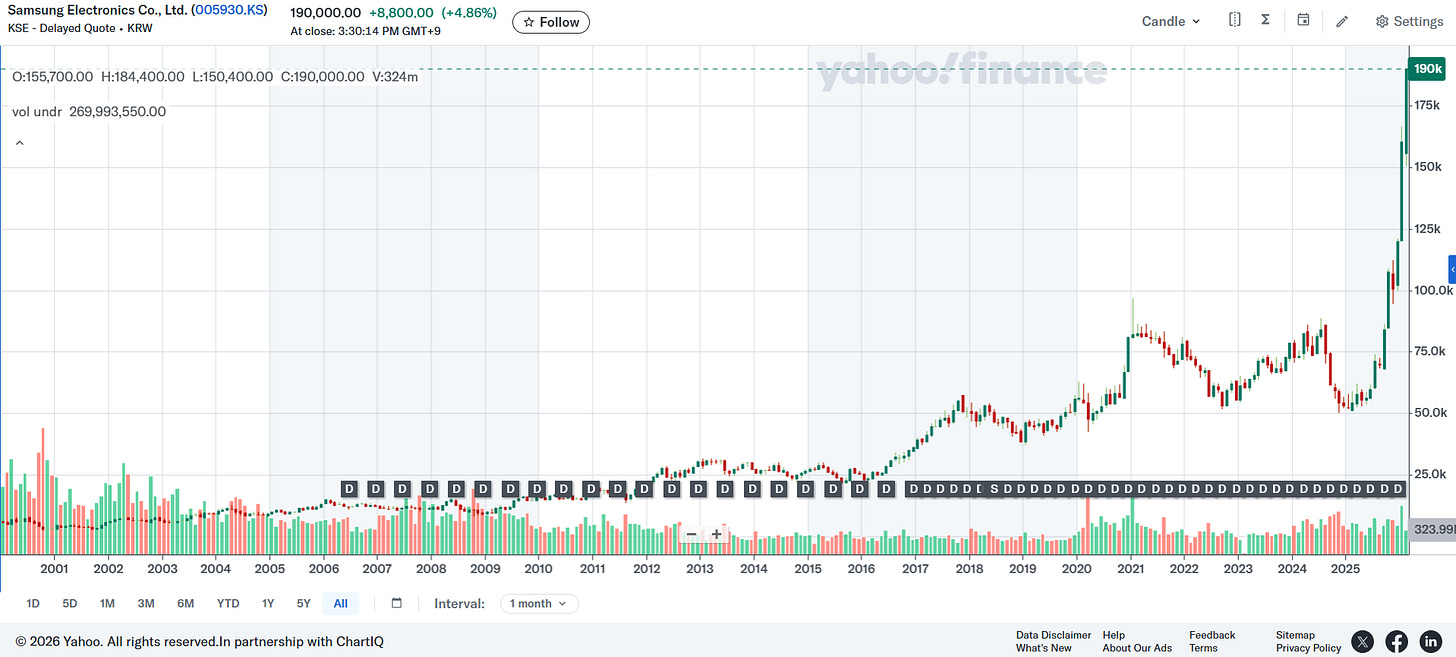

🔬 Samsung Electronics (005930 KS/Buy) – Increasingly favorable environment (Mirae Asset Securities) 01.30.2026 ⚠️

🔬 Samsung Electronics (005930 KS/Buy) – Major beneficiary of Nvidia’s advances (Mirae Asset Securities) 01.21.2026 ⚠️

🔬 Samsung Electronics (005930 KS/Buy) – Remarkable earnings and potential for additional shareholder returns (Mirae Asset Securities) 01.16.2026 ⚠️

🔬 Samsung Electronics (005930 KS) – No signs of slowing (Daishin Securities) 09-01-2026 ⚠️