Looking for the best credit card in India to suit your needs? You’re at the right place. Whether you need cashback, lounge access, complimentary hotel stays or business/first class redemptions, you can find everything here.

I’ve analysed 250+ credit cards in India across various banks and compiled a list of best credit cards for 2025 based on various user segments.

With about 10+ active credit cards in my wallet, below list covers most of the cards that I personally use and even more.

Entry Level Credit Cards

Suggested income: 5 Lakhs+

Suggested spend: 1 Lakhs+

Entry-Level credit cards, also called as credit cards for beginners are those cards that are targeted at first-time credit card users.

SBI Cashback Card

SBI Cashback Credit Card is one of the most simple yet generously rewarding cashback credit card that suits well for beginners, as it offers 5% Cashback on online spends (upto 1L spend/month) which is lucrative even after the recent devaluation.

*** Best Cashback Credit Card ***

Federal Scapia

While the rewards on Scapia Credit Card is comparatively low at 2% it comes with complimentary airport lounge access & shopping benefit which is quite useful if you’ve domestic travel.

*** Best Lifetime FREE Card ***

HDFC Swiggy

If you’ve significant spends on swiggy, then you’ll enjoy the 10% cashback on all Swiggy spends, including food delivery & Instamart along with 5% cashback on a wide range of online shopping portals.

Axis Cashback Card

While SBI Cashback & HDFC Swiggy Credit Cards are better cashback cards with less restrictions, Axis Cashback serves the need when your spends are more so you can stack it with other cashback cards.

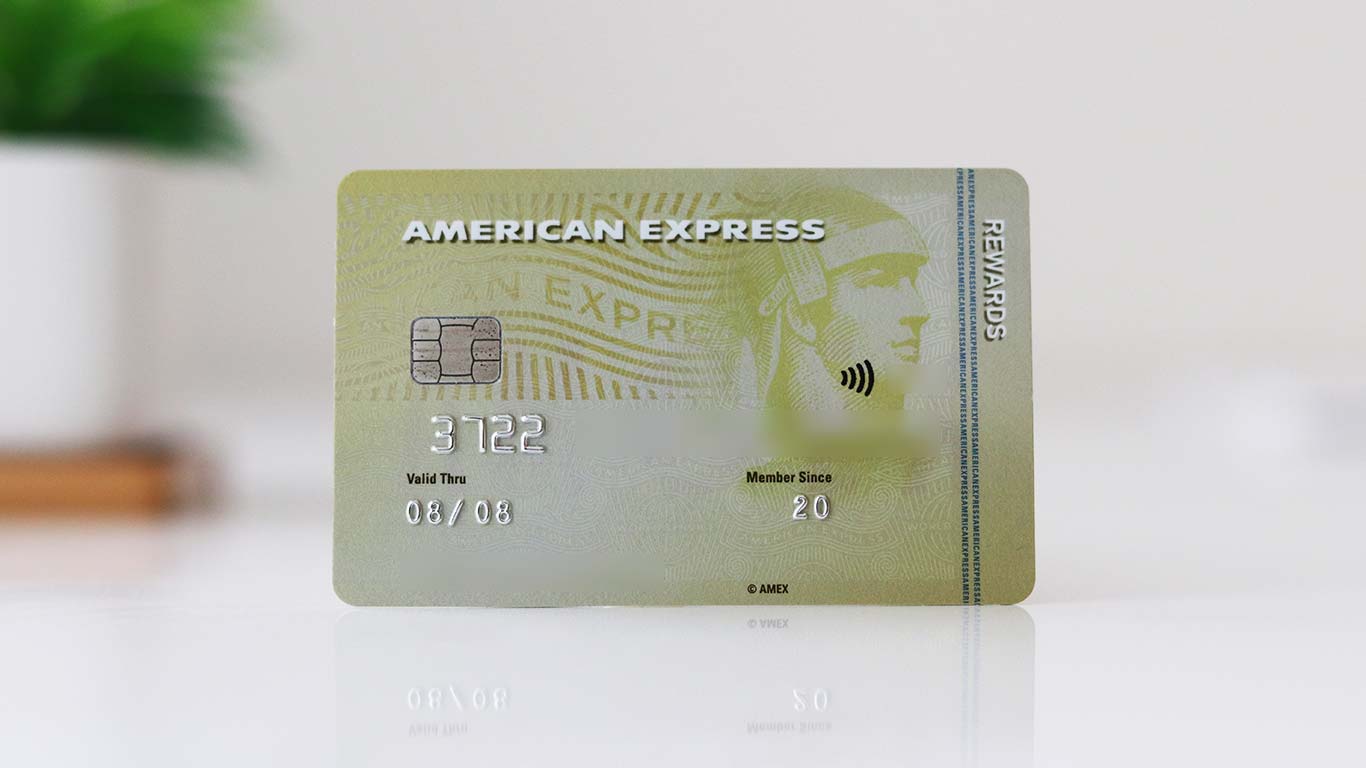

Amex MRCC

Best for: Gold Collection & Points Transfers

Read Review

American Express Membership Rewards Credit Card (MRCC) is the best way to get into the world of Amex. You can get 2000 MR bonus points monthly (20K spend), that gives you a sweet annual return of 6% on spends.

Note: Amex is expected to resume onboarding new cards on/before Oct 2025.

Other noteworthy cards in this segment: SBI Phonepe Select Black & HSBC Live+

Premium Credit Cards

Suggested income range: 12 Lakhs+

Suggested spend range: 6 Lakhs+

Premium credit cards comes into picture when your lifestyle has pinch of luxury factor to it. It comes with more travel benefits like domestic and international lounge access, better reward rate, etc.

HDFC Regalia Gold

The most important benefit of this card apart from rewards and points transfer at 2:1 (including Accor) is the ability to get add-on cards with Priority Pass for all family members, which shares the generous complimentary domestic & international lounge access limit with the primary card.

IDFC Mayura

IDFC Mayura is a wonderful card when you have significant forex spends as the 0% forex + rewards is quite lucrative which is as good as super premium cards.

HDFC Tata Neu Infinity

If you’re looking for a single UPI Credit Card, HDFC Bank Tata Neu Infinity Rupay Credit Card is the one that you need.

It not only gives decent rewards on UPI spends, but also offers lucrative 5% return on utility bill payments and more. On top of that, you may also purchase gift cards with 5% reward rate.

Travel Credit Cards

When your life has good amount of travel, that’s when you need to have these exclusive Travel credit cards.

Travel & airline credit cards are designed in such a way that you get travel vouchers/points/miles instead of cashback.

Axis Atlas

Axis Bank Atlas Credit Card comes with an amazing reward rate on regular spends and much more on select categories like direct hotels/airlines. It’s a hot pick for 2024 & 2025 and stands good even after it’s recent devaluation.

Note: Issuance restricted as of September 2025

HSBC Travel One

HSBC Travel One Credit card is a new and noteworthy card with it’s new accelerated rewards program. It’s particularly useful if you don’t have the HSBC Premier Credit Card.

Amex Platinum Travel

Best for: Redeeming Taj Vouchers Or for Marriott

Read Review

American Express Platinum Travel card is the best travel credit card in the country, hands down! It retains it’s name and fame for almost a decade now.

I personally enjoy using this card as it helps me to stay at one unique Taj property every year by using the complimentary Taj Vouchers that comes with it.

HDFC Marriott Bonvoy

While HDFC Bank’s Marriott Bonvoy Credit Card has poor reward rate on ongoing spends, it stands good for its incredible welcome and renewal benefits which can easily fetch twice or thrice the value of the joining fee.

Apart from the joining benefit, it’s particularly useful for domestic & international lounge access even for add-on’s which is similar to the Regalia Gold except that here the card works directly for the access.

RBL World Safari

RBL World Safari Credit Card is a hidden gem for frequent travellers as it not only offers the compete 1 Year international travel insurance but also comes with a 0% markup fee on international spends.

Super Premium Credit Cards

Suggested income range: 25 Lakhs+

Suggested spend range: 10 Lakhs+

Super premium credit cards are those that comes with higher reward rate, higher credit limit, unlimited lounge access, better card linked benefits & many more perks that you would need to enjoy a luxury lifestyle.

HDFC Diners BizBlack

If you’re into business, close your eyes and go for the HDFC Diners BizBlack Credit Card as it earns lucrative rewards not only on tax but also on bill payments.

Only downside though is the lower acceptance of Diners cards in India compared to Visa/MasterCard, which means you have to keep a backup card handy.

Yes Bank Marquee

Yesbank’s recently launched Marquee Credit Card is a pretty good Super Premium Credit Card especially if your spends are largely focused online, as it gives you amazing rewards (redeemable for travel) on online spends.

Stan C. Ultimate

Just like HDFC Infinia/Diners Black, Stan. C Ultimate card too comes with sweet 3.3% reward rate. The USP of this card is that you get reward points on almost ANY spend, lower rewards on select categories but still good.

Though the pain point with this card is the lack of good redemption options. Decent vouchers available now are: ITC, Titan, Starbucks, Fabindia & few more.

Other noteworthy cards in the super premium segment for select set of users: SBI Aurum & ICICI Times Black

HNI Cards

The HNI cards either demands high banking relationship or a lifestyle of a High Net-Worth individual.

Suggested spend range: 30 Lakhs+

Axis Magnus Burgundy

If your spends are over 3 Lakhs a month even for few months in a year, Axis Magnus Burgundy is perhaps the ONLY credit card you would ever need. it has everything you can dream of and even more.

Axis Olympus Credit Card is a good alternate if you already hold one, not open for new applications.

HSBC Premier

HSBC Premier Credit Card with its upgraded features and benefits is certainly useful for those who prefer to enjoy rewards on all kinds of spends. With it’s recent launch of accelerated rewards, it’s a wonderfully rewarding card for 2025.

HDFC Infinia

Infinia is everyone’s dream for ages without an exception. If you are looking for a single credit card for with great support and rewards, then Infinia will serve the need.

If you couldn’t get Infinia, Diners Black Metal is equally good with same ongoing reward rate.

ICICI Emeralde Private

ICICI Bank’s Emeralde Private Credit Card, is perhaps the first ever credit card in the history of ICICI Bank credit cards to carry a good reward rate of 3% on regular spends. And with the recent launch of iShop, it does serve the need.

Amex Platinum

Amex Platinum Charge Card has degraded a lot in the recent times, yet it still holds it’s value at-least for the first year, as you get much more benefits than what you pay for, thanks to the signup bonus.

Choosing the Card

Choosing the best credit card is lot simpler than how it used to be in the past, thanks to all the aggressive credit card offers around.

#1 If you’re a beginner to the game and have relatively low annual spends (<5L) with significant online spends, get the SBI Cashback or HDFC Swiggy Credit Card along with Scapia so you’re covered with best in class cashback + lounge access.

#2 If you spend >10 Lakhs a year, get HDFC Infinia and your entire family is taken care for lounge access, domestic and abroad apart from rewards.

#3 If you spend >30 Lakhs a year, consider exploring Axis Magnus Burgundy or HSBC Premier as per your profile.

While that’s the easy way to put it, if you have higher spends, you may need a personalized strategy and that’s where my 1-on-1 credit card consultation might come handy.

FAQ’s

Which is the best credit card in India for 2025?

Calculate your annual spend and choose the cards from the list above. The best card varies from one person to another.

How many Credit Cards can I have?

As many as you need. Start with 2 cards if you’re new to the system and increase the count gradually based on your spends. 5 cards is sufficient for most.

Which Credit Card has best customer service?

Amex is known for their premium customer support. You may also enjoy a similar treatment with any bank, as long as you take their super-premium cards.

Which Bank’s Credit Card is best in India?

HDFC Bank is the market leader and has very good merchant offers as well. So start with HDFC and add others as per your requirement.

Which is the best fuel credit card?

That’s a million dollar question as it’s quite a complicated subject that deserves a long answer. There is a modern method to save well over 10% on fuel spends, checkout Best Fuel Cards article for a detailed coverage on that.

Bottom line

India had never seen such wonderfully rewarding cards available to public both in affluent and retail (entry-level) categories in the history of Indian Credit Cards.

The Year 2025 is indeed the golden age of credit cards especially for beginners, as 5% cashback through multiple cards is happening for the first time in the industry.

What’s your thoughts about the above list of best credit cards for 2025? Feel free to share your opinion in the comments below. We shall amend the list if required.

![25+ Best Credit Cards in India for 2025 [For Beginners to High Spenders] – CardExpert](https://luximperiumholdings.com/wp-content/uploads/2025/09/25-Best-Credit-Cards-in-India-for-2025-For-Beginners-1024x576.jpg)