This article was originally published on June 25, 2024, and was updated as of June 23, 2025 to reflect timely credit information.

Key takeaways about avoiding credit trouble:

Many people fall into credit trouble simply because they don’t know the risks.

These six tips apply whether you’re building credit for the first time or trying to maintain a high score.

Late payments, maxed-out cards, and frequent credit applications can all damage your credit standing.

Educating yourself on how credit works – and working with a nonprofit credit counselor – can keep you on the right path.

A healthy credit score opens doors to homeownership, lower interest rates, and even job opportunities.

Now more than ever, your credit health plays a pivotal role in your financial future. Whether you’re trying to qualify for a mortgage, lease an apartment, finance a car, or simply get approved for a credit card, your credit score is the gateway. In today’s cashless, fast-paced economy, avoiding credit trouble isn’t just a smart financial move it’s essential to thriving in modern life.

At CredEvolv, we’ve seen firsthand how easy it is for consumers to fall into credit trouble. It often happens not because of recklessness, but because no one ever taught them the rules of the game. We believe knowledge is power. That’s why we’re sharing these six essential tips to help you avoid credit trouble – before it starts.

Whether you’re a young adult just beginning to build your credit or someone rebuilding after past missteps, this guide is designed to help you avoid the most common traps. From understanding how credit scores are calculated to learning what not to do with your credit cards, we’ll cover it all.

Here are six essential tips to help you avoid credit trouble before it starts.

1. NEVER Make a Late Payment

It’s worth repeating: NEVER make a late payment – on anything.

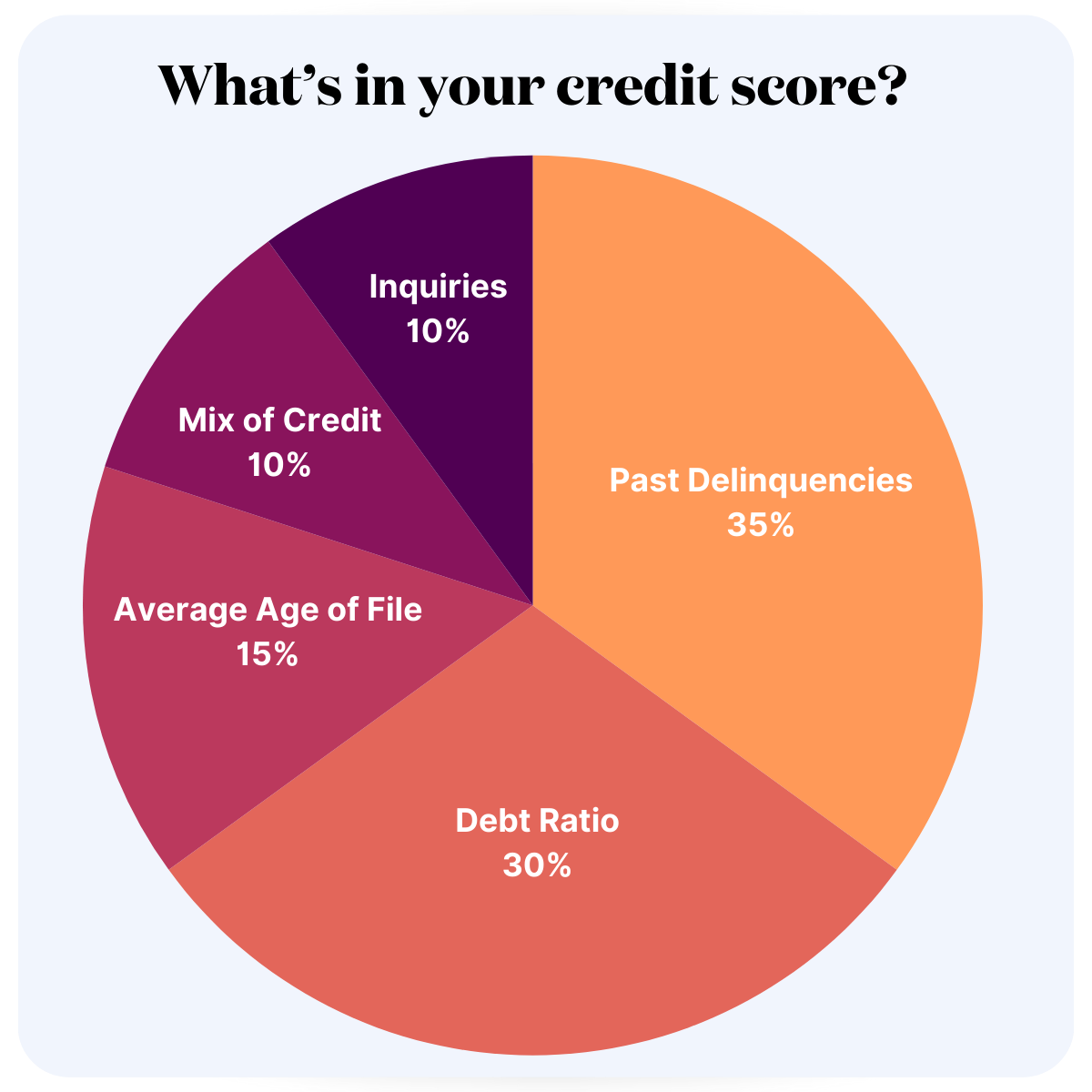

Your payment history is the single most important factor in your credit score, accounting for 35% of your FICO® score. Just one missed or late payment can cause your credit score to drop dramatically and stay on your credit report for up to seven years.

This includes:

Credit cards

Auto loans

Student loans

Mortgages

Even rent payments (if reported)

Late payments not only damage your score, they also trigger late fees and higher interest rates. If you’re consistently late, your account could be turned over to collections – something that can devastate your credit report.

Avoid credit trouble by:

Setting up automatic payments or calendar reminders.

Prioritizing minimum payments even when money is tight.

Communicating with your lender if you’re struggling – many offer short-term hardship solutions.

2. Keep Your Credit Utilization Low

Another major factor in your score is your credit utilization ratio– the amount of credit you’re using compared to the total available limit. This accounts for 30% of your credit score.

Maxing out your credit cards or maintaining high balances – even if you pay on time can hurt your credit standing.

For best results:

Keep your utilization below 30%, ideally under 10% for top-tier credit scores.

Pay off your balances in full each month when possible.

Avoid carrying a balance month to month to sidestep interest charges.

For example, if you have a credit limit of $5,000, you should aim to keep your balance below $1,500—and ideally under $500.

Tip: Sometimes, requesting a credit limit increase (without a hard inquiry) can help improve your ratio without adding new debt but only if you resist the temptation to spend more.

By all means, educate yourself on these concepts to make informed financial decisions, but be careful about DIYing your credit improvement efforts.

3. Don’t Close Old Credit Card Accounts

This one might seem counterintuitive. You might think closing a credit card you don’t use is a smart way to simplify. But that can actually hurt your score by:

Reducing your overall credit limit, which raises your utilization ratio.

Shortening your average age of accounts, which makes up 15% of your credit score.

Even if you don’t use an old card often, if it doesn’t charge an annual fee and has a clean history, consider keeping it open. Use it occasionally for small purchases and pay it off immediately to keep it active.

Avoiding credit trouble means keeping your positive accounts open – they’re working in your favor.

4. Limit How Often You Apply for Credit

Applying for new credit too frequently can also spell trouble. Each time you apply for a credit card, personal loan, or auto loan, a hard inquiry is placed on your report. Too many inquiries in a short period can drag your score down – especially if lenders view it as a sign of financial distress.

Hard inquiries make up 10% of your score. While one or two won’t hurt much, multiple applications can look risky.

Instead:

Be selective about which cards or loans you apply for.

Use prequalification tools that trigger soft inquiries to check offers without damaging your score.

Avoid signing up for every store credit card just to get a discount at checkout.

Being strategic with your credit applications is key to maintaining a healthy score and protecting your financial reputation.

5. Be Cautious About Co-Signing

We get it helping someone you care about is honorable. But co-signing on a credit application is a big financial risk.

When you co-sign, you’re legally responsible for the debt. If the other person misses payments or defaults, your credit takes the hit. That includes:

Lower credit scores

Late payment notations

Potential collections

Legal responsibility for the full amount owed

If your loved one is responsible, great. But if not, your willingness to help could backfire badly.

Before you co-sign:

Ask yourself if you’re willing and able to pay off the loan if necessary.

Review their financial habits and repayment history.

Set boundaries and maintain open communication.

Many consumers who end up on the CredEvolv platform are dealing with the aftermath of well-intentioned co-signing gone wrong.

6. Understand How Credit Works Before Using It

This might be the most important tip of all.

If you don’t understand how interest rates, minimum payments, and credit reporting work, you could unintentionally dig yourself into a hole. Many people try to repair their credit on their own, not realizing how complex the system is – or how easily a small mistake can snowball.

DIY credit repair often backfires. That’s why we recommend working with certified nonprofit credit counselors, like the ones you’ll find on the CredEvolv platform.

Our counselors help you:

Understand what’s actually affecting your credit score

Dispute errors legally and effectively

Create a budget and personalized action plan

Rebuild your credit with strategies that work – and stick

Avoid credit trouble by getting educated before you act. And if you’re feeling overwhelmed, that’s okay. The right guidance can change everything.

Why It Matters: The Real-Life Impact of Credit Trouble

Poor credit doesn’t just affect your ability to get loans. It can impact:

Interest rates on car loans and mortgages (which could cost you thousands)

Credit card approvals and terms

Rental applications

Insurance premiums

Even job offers in some industries

A bad credit score can shut doors. A good one opens them.

Where CredEvolv Comes In

At CredEvolv, we help you take control of your financial future with expert guidance – not gimmicks. Unlike for-profit credit repair companies that promise quick fixes, we connect you with nonprofit credit counselors who provide real, legal, long-term solutions.

Our platform is built on education, transparency, and empowerment. Whether you’re starting from scratch or climbing back after a setback, we’re here to help you make informed decisions, avoid costly pitfalls, and build a better financial life.

Start Your Journey Today

Avoiding credit trouble doesn’t require perfection. It just takes awareness, discipline, and the right support system.

Remember these six tips:

Never make a late payment.

Keep your credit utilization low.

Don’t close old accounts.

Limit how often you apply for new credit.

Be cautious about co-signing.

Learn how credit works before using it.

If you’ve already made mistakes, don’t panic. Millions of people have been where you are – and come out stronger on the other side. With CredEvolv, you don’t have to do it alone.