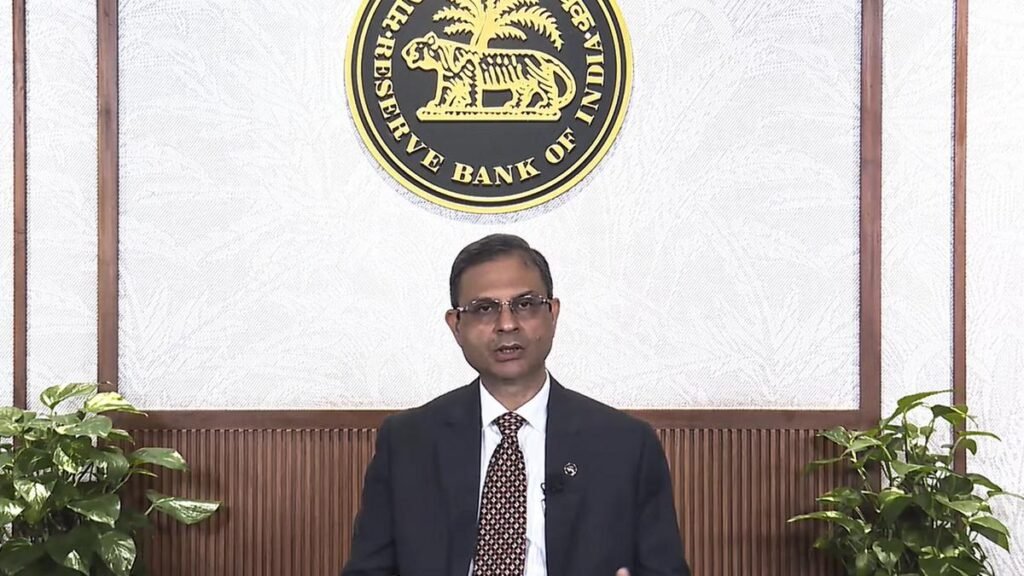

Reserve Bank of India (RBI) Governor Sanjay Malhotra delivers the Monetary Policy statement on Wednesday

| Photo Credit:

PTI

Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday says even as India’s home-grown digital payments mechanism, Unified Payments Interface (UPI), is free for users, there are costs associated with running the payments rail and someone in the system must absorb it, either on an individual or collective basis.

Edited excerpts:

Few banks are charging payments aggregators a fee for UPI transactions. What is the regulator’s view on it?

Governor: There are costs [linked to running UPI] and these costs have to be paid by someone. Who pays is important but not so important than someone footing the bill. It is important for us for the sustainability that whether collectively or individually someone pays for it. I never said that it cannot remain free forever. My sense is that it is not free even now. Someone is paying for it, the government is subsidising it. But somewhere the costs are being paid. The question really is who pays for it. I never said that users will have to pay. I have mentioned that government policies have helped in expanding use of UPI.

How much of the tariff impact has been factored in while considering full year GDP growth?

On growth, you are well aware that we have already reduced our GDP growth forecast from 6.7 per cent to 6.5 per cent. Some of the global uncertainties have already been factored in the revised growth forecast. However, there’s still a lot of uncertainty and it’s very difficult to predict what the impact will be (of tariffs). Going forward, we will maintain close vigil on incoming data and take a call. As of now, we don’t have sufficient data to revise our GDP forecast.

Do you worry about rise in inflation on account of global volatility?

In India, we are less dependent on the foreign factors when it comes to inflation. The other thing is, if at all there is an impact, there is also an impact on growth and demand side. That in itself has a reverse impact. We elaborated this in our MPC statement some months back. As of now, we don’t see major impact (on inflation) unless there are retaliatory tariffs, which I really don’t foresee.

Deputy Governor Poonam Gupta: Our inflation basket, nearly half of it comprises of food, which doesn’t get affected directly by global developments. A significant part consists of non-tradeables, which again doesn’t get impacted by global factors. So to that extent, the direct impact of evolving uncertainties on India’s inflation is likely to be very limited.

Housing loans, which typically takes-off post rate cuts, is also showing slower pace of growth. What are the key reasons for it?

Governor: It is important to look at data on a regular, macro basis. But to extract signals out of that, I think we should be hesitant. It is the long term data which is relevant for making any insights out of it. These fluctuations will be there. There will be noise, but you have to remove the noise while looking at data on a month to month or year to year basis. When it comes to housing credit, it is doing well, it may have moderated a bit but that is to be expected. Overall, housing credit growth is 14 per cent, which is more than average credit growth rate of about 10 per cent that we are having this year. And some impact of rate cuts happen with a lag. People takes time for people to make investment in a home as it is a long term investment.

Published on August 6, 2025