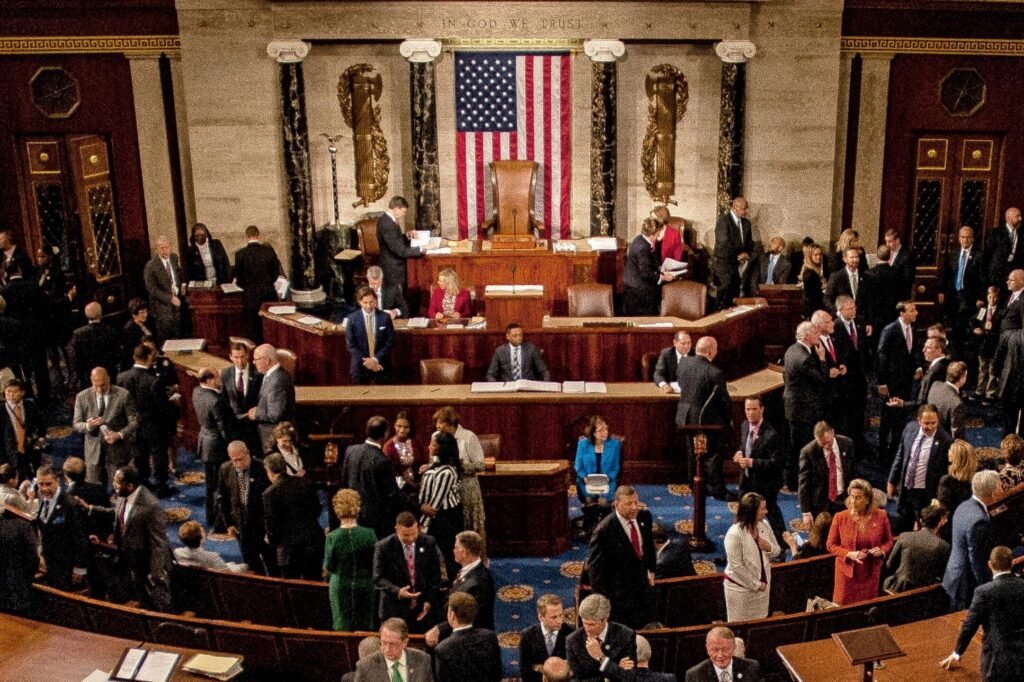

By a 218-to-214 vote, the House of Representatives today passed the One Big Beautiful Bill Act, the massive budget reconciliation bill that includes many of the GOP’s tax and spending priorities. Included in the bill were several ABA-supported tax provisions related to banks. ABA President and CEO Rob Nichols congratulated congressional leaders on the bill’s passage, noting that the ABA-supported measures “will make banks stronger and better able to serve their customers and communities.”

Among the provisions included in the reconciliation bill were:

A modified version of the ABA-advocated ACRE Act, under which banks will be permitted to exclude from gross income 25% of interest income derived from certain qualified real estate loans without a sunset date.

The permanent extension of the Section 199A pass-through deduction rate of 20%, which levels the playing field for Subchapter S banks.

An exemption from remittance tax for almost all transfers from banks and thrifts.

A permanent increase to the state housing credit ceiling and a lowering of the bond-financing threshold for projects financed by bonds, beginning in 2026.

Permanent extension of the New Markets Tax Credits that banks use to support growth in distressed communities

Permanent extension of increased estate tax and gift tax exemption amounts.

A permanent 100% bonus depreciation effective for most property placed in service on or after Jan. 19, 2025.

Permanent expensing for domestic R&D expenditures paid or incurred in tax years beginning after Dec. 31, 2024.

A reinstatement of the EBITDA (instead of EBIT) limitation under Section 163(j) for tax years beginning after Dec. 31, 2024.

Permanency and enhancements for the Opportunity Zones program.

Changes to the health savings account landscape, including bronze and catastrophic plans treated as high-deductible health plans.

A reduction in the amount of funding the CFPB can request from the Federal Reserve.

“Having certainty about the tax code moving forward will allow banks of all sizes and their more than two million employees to provide even more support to the U.S. economy,” Nichols said. President Trump is expected to sign the bill into law tomorrow.