Here is an overview and summary of current views on Stablecoins based on research attributed to Perplexity.ai.. There are good reasons for USDC to be a legitimate Stable Stablecoin, but so many opinions and views often with proprietary positions to maintain, that the effect of the Genius act is being lost in that morass. This blog is about direction not particular stocks, but the freewheeling nature of crypto is winning the battle for clarity. And the Bank for International Settlements (BIS) report (attached below) is thrown into the mix taking the approach everyone is wrong except the author. It is a good read with legitimate points but not directly attributable to the core point which is reflected in the need for Stablecoin definition. The BIS report is indicative of sowing un-necessary confusion, rather than properly clarifying reality, capturing the current regulatory framework and indicating where adjustments are needed.

The current state is beautifully summarized by Bloomberg’s Emily Nicolle

In the last month alone, Fiserv Inc., Kakaopay Corp., Amazon.com Inc., Walmart Inc. and Banco Santander SA were among the names reported to have thrown their hat into the ring to create — or at least contemplate creating — their own stablecoins. Typically tied to the US dollar or another traditional currency, stablecoins rely on reserves of safe assets to maintain their worth and generate profits for their issuers.

The arrival of US legislation governing stablecoins, which is expected to be completed later this summer, is buoying plans since the prospect of a clearer regulatory playing field is making it easier for traditional firms to enter the space.

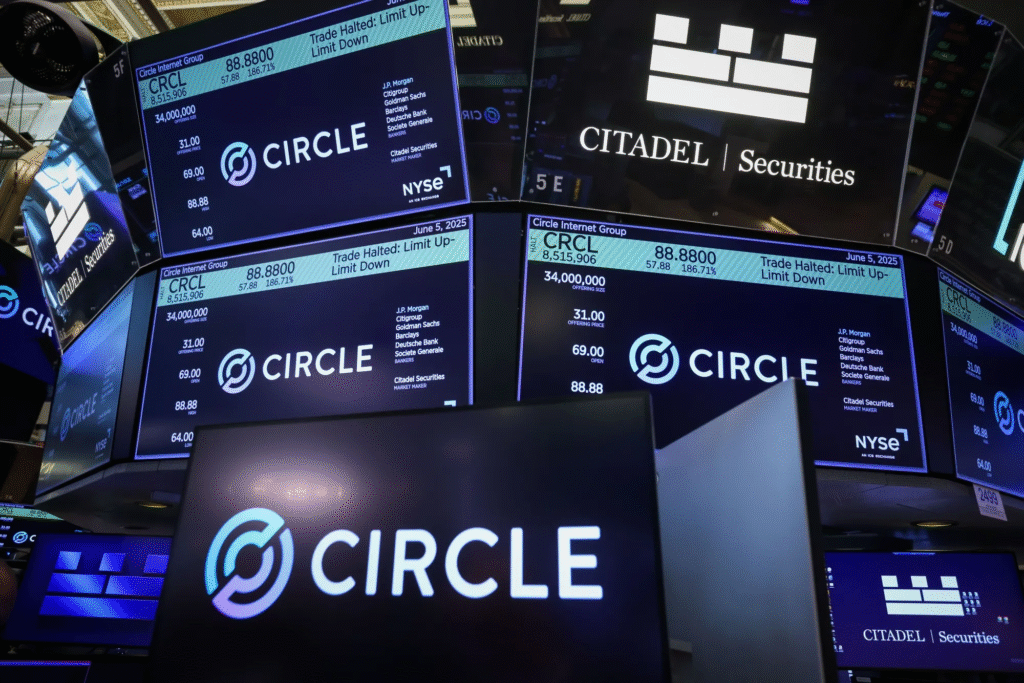

Some companies, like Fiserv, are using infrastructure from existing providers like Circle and Paxos Inc. to build their token, rather than starting from scratch. Fiserv also says its stablecoin will be interoperable with other tokens on the market, a vital component if it hopes the coin can be competitive.

Without the technical know-how, launching a token is hardly an easy process. Critics point out that expansion in this area will likely require reliance on several intermediaries, reducing some of that efficiency appeal. What’s more, the global patchwork of regulations overseeing stablecoins can differ greatly, creating compliance headaches.

Research summary with sources and attributions. Researched in Perplexity.

In summary, with legislative progress supporting, the stablecoin sector is entering a pivotal new phase of growth and legitimacy. The recent passage of the GENIUS Act by the U.S. Senate marks the first time federal guardrails have been established for U.S. dollar-pegged stablecoins, mandating full reserve backing, monthly audits, and compliance with anti-money laundering laws. This regulatory clarity is expected to foster institutional and retail confidence, enabling banks, fintechs, and major retailers to issue or integrate stablecoins into their payment infrastructures, and is projected to expand the U.S. stablecoin market potentially eightfold to exceed $2 trillion in the coming years.

The GENIUS Act not only sets a federal framework but also allows for state-level regulation, creating multiple pathways for permitted issuers and qualifying foreign entities to participate in the U.S. market. This dual approach is designed to balance innovation with oversight, ensuring both consumer protection and market stability. The Act’s passage signals bipartisan recognition of the need for clear stablecoin regulation and is expected to accelerate global adoption of dollar-based digital assets, reinforcing the U.S. dollar’s role in international payments and digital finance.

As the legislation moves to the House, where a companion bill (the STABLE Act) awaits, the expectation is that regulatory certainty will drive further market expansion, increased institutional participation, and new opportunities for innovation in payment systems, remittances, and cross-border finance. This marks a structural shift, positioning compliant stablecoins as a core component of the future financial ecosystem.

_____

Latest Government and Financial Institution Reports on Stablecoin Adoption Trends

Recent reports from governments and major financial institutions indicate that stablecoin adoption is accelerating globally, driven by regulatory clarity, institutional integration, and evolving payment infrastructure.

Key Trends and Findings

Regulatory Momentum and Legislative Developments

• In the United States, 2025 has seen significant progress toward a comprehensive federal framework for stablecoins. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act and the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act are advancing through Congress, aiming to establish clear licensing, reserve, audit, and consumer protection requirements for stablecoin issuers. These bills are expected to foster trust and mainstream adoption by mandating one-to-one reserve backing, regular audits, and robust consumer safeguards (Zaslowsky, 2025; Reuters, 2025).

• The Trump administration’s executive order in January 2025 explicitly promoted stablecoins as essential to the U.S. financial infrastructure, directing agencies to support fiat-backed stablecoins and halting federal CBDC development (Amberdata, 2025).

Institutional Adoption and Use Cases

• Nearly half (49%) of surveyed global financial institutions are already using stablecoins for payments, with another 41% in pilot or planning phases. Adoption is no longer limited to fintechs; Tier-1 banks, regional lenders, and payment processors are integrating stablecoins for cross-border payments, B2B transactions, and treasury management (Fireblocks, 2025).

• Examples include Bancolombia’s COPW stablecoin for retail settlement and Banking Circle’s EURI for B2B platforms, illustrating the mainstreaming of stablecoin infrastructure in both emerging and developed markets (Fireblocks, 2025).

Market Growth and Projections

• The global stablecoin market cap has grown over 20% in 2025, reaching $247 billion, and is projected to reach $1.4 trillion by 2030 (ARK Invest, 2025). Monthly USDC transfer volumes alone approached $585 billion in March 2025, underscoring strong institutional demand (Amberdata, 2025).

• Payment giants such as Visa, Mastercard, and Stripe have launched stablecoin-powered products, further embedding stablecoins into global commerce (Fireblocks, 2025).

Regulatory and Supervisory Guidance

• The Office of the Comptroller of the Currency (OCC) reaffirmed that U.S. banks may engage in stablecoin activities, while also rescinding prior guidance to clarify regulatory expectations (Deloitte, 2025).

• New legislation requires stablecoin issuers to maintain high-quality, liquid reserves, prohibits interest payments on stablecoins, and establishes clear consumer protections (Reuters, 2025; Zaslowsky, 2025).

Central Bank and BIS Perspectives

• The Bank for International Settlements (BIS) and other central banks continue to warn that stablecoins, while efficient for cross-border payments, may pose risks to monetary sovereignty and financial stability if not strictly regulated. BIS recommends that stablecoins play only a subsidiary role in the monetary system (Deloitte, 2025).

References (APA)

Bank for International Settlements report on Stablecoins Jun 25, 2025.