As mentioned Sunday, I am busy with an almond harvest (specifically, walking up and down every row – almond prices for growers have been recovering) that should be finished by tomorrow or Thursday. So next week’s Monday post will clear out the rest of my email-inbox…

$ = behind a paywall

$ = Behind a paywall / 🗃️ = Link to an archived article / ⛔ = Article archiving may not be working properly

🇨🇳 Despite tariffs, Temu and SHEIN continue to grow? (Momentum Works)

However, last week, Chinese business media outlet LatePost reported both companies still maintained double digit growth in the first half of 2025. (Originally article in Chinese here).

Below are some excerpts from the article which we find interesting, translated into English by the MW team. Do note that the numbers in the excerpts are reported by LatePost, Momentum Works is not endorsing their accuracy. In fact, sources closer to the truth told us that the numbers “might not be very accurate“, but nonetheless there are some interesting pointers in the report to help us better piece together the ongoing dynamics.

We have also built a cheat sheet below for the multiple fulfilment models mentioned in the article:

🇨🇳 Baidu (BIDU): A Return to Growth? (Coughlin Capital)

Maybe boring search isn’t so boring anymore

I’ve been thinking about Baidu (NASDAQ: BIDU) a lot lately. Not for the usual headlines about AI breakthroughs or their robotaxi ambitions, but for something far less glamorous—and, in my view, potentially more impactful to next week’s earnings—the state of their core business.

Baidu’s bread and butter is still search and performance marketing, and the Baidu App (which bundles search, news, and other content) is the primary front door. It doesn’t get the same attention it used to. It’s not flashy, and it certainly doesn’t enjoy the hype cycle that large language models or robotaxi’s do. But it’s still the engine that pays the bills.

And in the last few months, the environment for that business has started to look a lot healthier.

🇨🇳 Xunlei rediscovers its ‘thunder’ with return to video roots (Bamboo Works)

The provider of cloud and video services’ revenue rose 30.6% in the third quarter, boosted by an 86% rise for its livestreaming services

Xunlei (NASDAQ: XNET)’s stock is up more than fivefold over the last year, including a 96% rise over the last three days, after it reported its revenue rose 31% in the second quarter

After largely abandoning its original video roots for cloud-based services, the company appears to be finding new success with overseas livestreaming

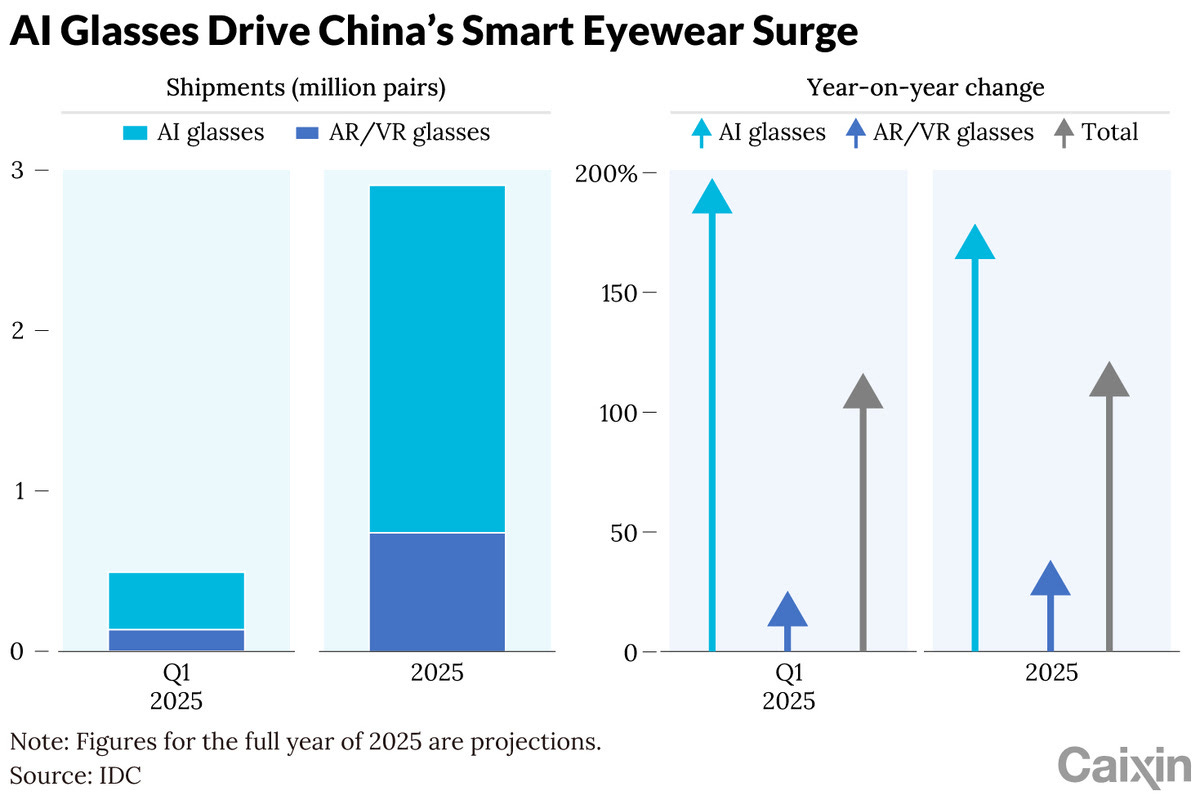

🇨🇳 In Depth: AI Glasses Lead a New Wave of Wearable Tech (Caixin) $

A new wave of Chinese-made smart consumer hardware is coming over the horizon, with tech heavyweights and startups making aggressive moves into the artificial intelligence (AI)-powered wearables market, both in their home market and beyond.

In June, Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) started selling its first pair of AI glasses, with features including video recording and calls, QR code scanning for mobile payment, simultaneous translation and a voice assistant that can be used to control other Xiaomi gadgets.

🇨🇳 Inside China’s Robotaxi Boom (The Great Wall Street) $

I rode China’s new wave of robotaxis through storms, night traffic, and crowded streets — here’s what works, what doesn’t, and how fast they might scale.

Here is the prequel to this article, in case you missed it.

China’s Robotaxi Race Hits an Inflection Point — But Baidu Risks Falling Behind again

In this article, I share first-hand experiences riding China’s latest robotaxis, what stood out on the road, detailed maps of where they actually operate, and my own take on how the next stage of this race is likely to unfold.

🇨🇳 BYD (1211 HK)’s Current Relief Rally May Lead to Another Pullback (Smartkarma) $

After an explosive rally in the first part of the year BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) started to sputter in mid-May and has been downtrending since.

BYD was starting to be oversold at the end of last week, as shown in our latest Global Markets Tactical Outlook WEEKLY insight, but this week started a relief rally.

However, the current trend pattern is NOT BULLISH according to our model, the stock could fall again after a 1-2 weeks bounce. Profit target: 116-123 price zone.

🇨🇳 Beijing scraps suburban home-purchase limit in latest stimulus push (Caixin) $

Authorities in China’s capital have scrapped decade-old restrictions on the number of homes residents can buy in its sprawling suburban areas, a significant move aimed at propping up a sluggish property market and reducing a glut of unsold apartments.

Announced on Friday, the policy removes the cap on property purchases for eligible families in all areas outside the city’s Fifth Ring Road — a major highway encircling the city’s central districts. The move targets the bulk of Beijing’s real estate market and signals a more aggressive, targeted push to revive the sluggish sector without igniting speculative fever in the city’s core.

🇨🇳 Curtain falls on Evergrande as Hong Kong delisting looms Aug. 25 (Caixin) $

China Evergrande Group will be delisted from the Hong Kong Stock Exchange later this month, marking the final chapter for the world’s most indebted property developer after its collapse triggered a crisis across China’s real estate sector.

The exchange’s Listing Committee decided to cancel the company’s listing from the start of trading on Aug. 25, Evergrande said in a filing Tuesday evening. Its last trading day will be Aug. 22, and it is not seeking a review of the decision.

🇨🇳 In Depth: China’s inclusive finance success leaves banks burdened (Caixin) $

Inclusive finance has been a runaway success in China.

The idea is to offer a helping hand to individuals and businesses that banks don’t typically view as ideal customers, as well as those who lack access to basic banking services. The goal is to provide these borrowers with accessible, affordable loans and other financial services so they can better contribute to the economy.

According to central bank rules, an inclusive small business loan, for example, would be one under 10 million yuan ($1.4 million) that’s granted to a small company, individual enterprise or self-employed person.

🇨🇳 Ant Group’s Deal for Hong Kong Broker Hits Mainland Snag (Caixin) $

Ant Group Co. Ltd.’s bid to acquire a Hong Kong-listed securities firm has stalled, as difficulties in securing Chinese mainland regulatory approval weigh heavily on the Alibaba (NYSE: BABA)-affiliated fintech giant’s expansion into securities, Caixin has learned.

No substantive progress on the acquisition of Bright Smart Securities and Commodities Group Ltd. (HKG: 1428 / FRA: 0BX) has been announced since the deal was unveiled in April, sources familiar with the matter told Caixin.

🇨🇳 Slowing economy haunts undertaker Fu Shou Yuan (Bamboo Works)

China’s top funeral services provider fell into the red in the first half of this year, extending a year of revenue and profit declines in 2024

Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF) said it lost up to 260 million yuan in the first half of this year, sparking a 9% selloff of its stock

With a land bank of 2.83 million square meters, nearly half in Shanghai, the death care operator still has plenty of space left to serve its customers

🇨🇳 The secret sauce behind Tingyi’s rising profits: Price hikes (Bamboo Works)

The instant noodle and beverage maker’s profit rose 21% in the first half of the year after the company raised its prices, resulting in a slight dip in its revenue

Tingyi Holding (HKG: 0322 / FRA: TYG / OTCMKTS: TCYMF / TYCMY)’s profit rose by over 20% in the first half of the year, even as its revenue fell by 2.7%

The instant noodle and beverage maker’s gross profit margin increased by nearly 2 percentage points during the period

🇨🇳 Nongfu Spring and China’s Bottled Water Wars (Asianometry) 26:07 Minutes

Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) emerged out of China’s Thousand Island Lake to become the country’s largest water seller. Today, its founder is China’s richest man, more or less, with a fortune valued at nearly $60 billion. The history of Mainland China’s bottled water industry is wild with episodes of scandal, health pseudoscience, and random bouts of cancel culture. How much drama can a water company twist open? You might be surprised. In this video, a Chinese water business.

🇨🇳 From ‘magic tea’ to dietary drugs, can Besunyen reclaim its glory days? (Bamboo Works)

Once a household name known for its ‘slimming tea,’ the company is looking for a new formula in dietary drugs after years of losses and asset sales

Besunyen Holdings Co Ltd (HKG: 0926) logged a net profit of 12.4 million yuan in the first half of 2025, up 46% year-on-year, as its newer line of dietary drugs gained traction

Revenue from the company’s dietary drug business has risen to 38% of its total, gradually reducing its long-time reliance on tea products

🇨🇳 XtalPi scores landmark deal for AI drug discovery (Bamboo Works)

The biotech has partnered with U.S. firm DoveTree in a collaboration worth up to $5.99 billion, adding to a slew of major deals for Chinese research firms this year

XtalPi Holdings (HKG: 2228 / OTCMKTS: QNTPF)’s U.S. partner was founded by a celebrated Harvard scientist who has a track record in delivering viable drugs

The deal, which was welcomed by investors, mostly consists of milestone payments, with upfront sums amounting to just $100 million

🇨🇳 Falling global birth rates drag Jinxin into the red (Bamboo Works)

The fertility services provider lost up to 1 billion yuan in the first half of this year after taking large impairment charges on its U.S. and Laotian operations

Jinxin Fertility Group (HKG: 1951 / FRA: 3NX / OTCMKTS: JXFGF) lost up to 1 billion yuan in the first half of 2025, primarily on impairment charges related to businesses it acquired in the U.S. and Laos

The charges suggest the fertility services provider’s U.S. and Laotian units are underperforming expectations amid globally declining birth rates

🇲🇴 Eason Chan’s concerts a boost for Galaxy Macau casino business in August: Citi (GGRAsia)

The average premium mass-market live-baccarat table bet observed in Macau for Citigroup’s August betting survey was up 10 percent year-on-year, to HKD21,543 (US$2,744), the institution said in a Sunday note.

“We are pleasantly surprised,” wrote analysts George Choi and Timothy Chau, adding that concerts by Hong Kong singer Eason Chan had probably helped Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) in particular during the period.

Citi stated that while August is “seasonally the strongest month” in terms of visitor volume, “it is also usually the month where we see dilution in average wager/player, given most incremental visitors are casual players”.

🇲🇴 Wynn Macau Ltd proposes issuing notes to improve its financial flexibility (GGRAsia)

Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) plans to issue debt to raise funds – with the amount still to be determined – for general corporate purposes. The latter would include to “repay outstanding indebtedness”, such as under the firm’s “WM Cayman II Revolver and/or one or more series of the existing notes”.

The company told the Hong Kong Stock Exchange on Monday that it is proposing to offer the senior notes to professional investors. “Pricing of the senior notes will be determined through a book building exercise to be conducted by the joint global coordinators and the joint bookrunners,” the firm said.

In a release on Monday, Fitch Ratings Inc said it has assigned a ‘BB-‘ rating to Wynn Macau Ltd’s “anticipated US$500 million of new senior unsecured notes due 2034”.

🇲🇴 Wynn Macau Ltd upsized note issuance a sign of ‘strong demand’: Lucror (GGRAsia)

The issuance of US$1.0 billion of 6.750-percent senior notes, due in 2034, enables Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) to repay the US$1.0-billion notes due in January next year, says a memo from Lucror Analytics, a Singapore-based specialist in credit research.

“The transaction was upsized to US$1.0 billion from US$500 million,” observed the institution, in a note carried on the Smartkarma platform.

“The upsized issuance suggests strong demand for the notes, amid tight spreads in Asia credit, as well as recent improvement in the Macau gaming sector, with industry GGR growth accelerating in June and July,” wrote Lucror Analytics senior credit analyst Leonard Law.

“Moreover, there have been no new Macau gaming bond issuances since mid-2024,” he added.

🇲🇴 1H profit at Galaxy Entertainment up 19pct to US$667mln, declares interim dividend (GGRAsia)

Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) reported a first-half profit of HKD5.24 billion (US$667.6 million), up 19.4 percent from the prior-year period. The firm also announced an interim dividend of HKD0.7 per share, payable on October 31.

The information was given in a filing to the Hong Kong Stock Exchange on Tuesday.

Galaxy Entertainment reported net revenue of nearly HKD23.25 billion for the six months to June 30, 8.3-percent higher than a year earlier.

Group-wide adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) were nearly HKD6.87 billion in the first half, a 14.2-percent increase year-on-year.

🇹🇼 TSMC: Reiterating Strong Buy, Moat Remains Wide As AI Boom Isn’t Slowing Down (Seeking Alpha) $ 🗃️

🇰🇷 Why We’re Eyeing KRX’s Sep 29 KCMC Event for Dividend Momentum Trades (Smartkarma) $

KCMC 2025 will likely reveal fresh, unpriced stimulus details, potentially sparking a price rally like last year’s 2% KOSPI 200 jump on the value-up ETF rollout.

The key wildcard at KCMC 2025 is dividends—shifting from Yoon’s Japan-style ROE grind to a Taiwan-style push for bigger shareholder payouts.

With Sept 29 approaching, dividend policy buzz may drive price moves—smart to prep dividend momentum trades to front-run this catalyst.

🇰🇷 Lee Jae-Myung to Meet Trump: Impact on North Korea Economic Reconciliation Stocks (Douglas Research Insights) $

It was reported today that the new South Korean President Lee Jae-Myung will meet US President Trump on 25 August in Washington DC.

In this insight, we discuss in particular how the meeting between Lee and Trump could lead to some outperformance of the North Korean economic reconciliation stocks.

We provide a list of 10 South Korean companies that are beneficiaries of increased economic reconciliation with North Korea. These 10 stocks are up on average 109% YTD.

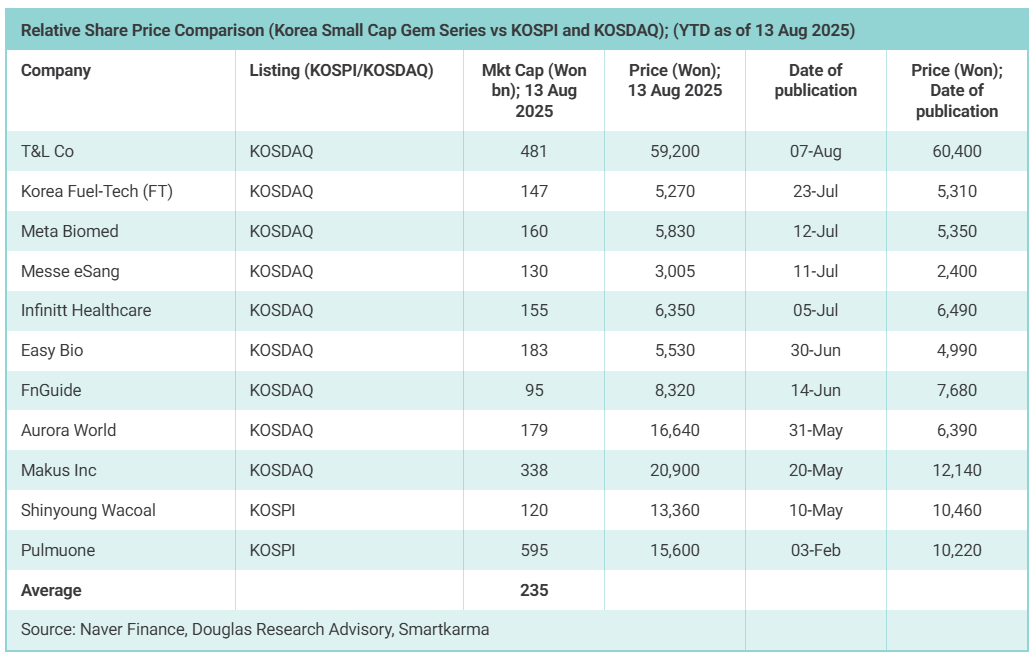

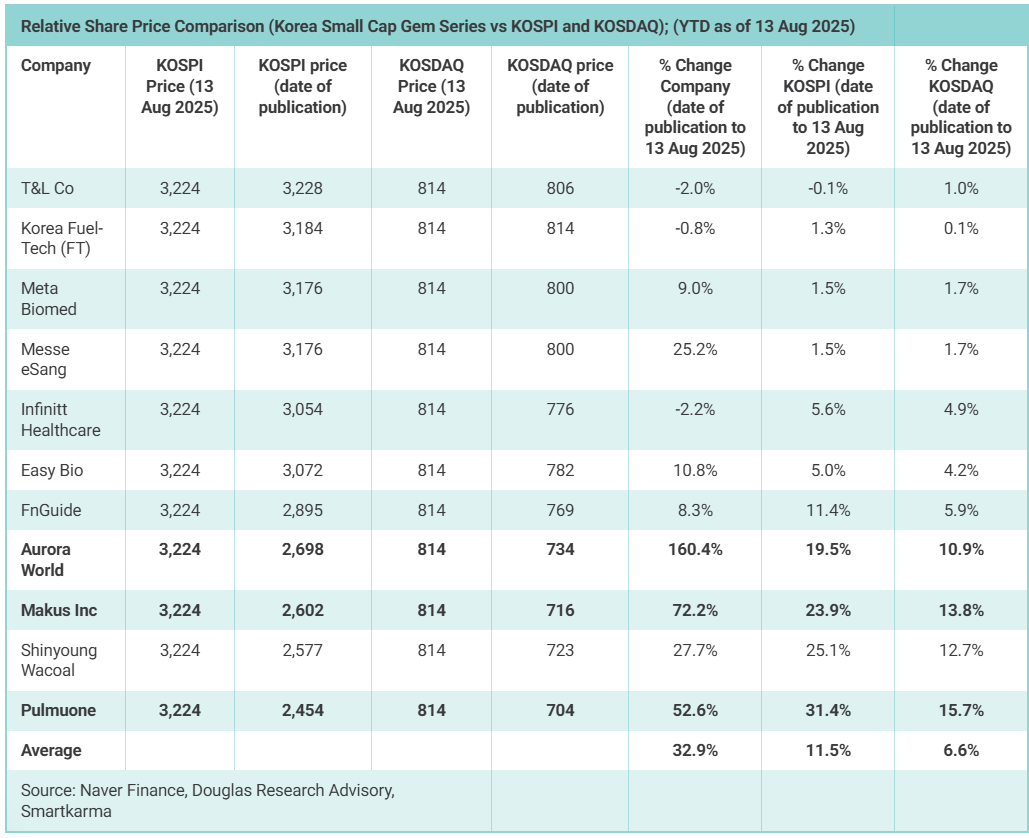

🇰🇷 A Review of Korea Small Cap Gem Series So Far in 2025 and Small Caps as Important Market Indicator (Douglas Research Insights) $

In this insight, we review the relative performances of the 11 Korea Small Cap Gem series published so far in 2025 (as of 13 August).

We also argue how small caps could be one of the important indicators in the Korean stock market.

These 11 stocks are up on average 32.9% (from date of the Korea Small Cap Gem series publication to 13 August 2025). These 11 stocks have significantly outperformed KOSPI and KOSDAQ.

🇰🇷 SKC: Plans to Issue EB Worth 125 Billion Won (Douglas Research Insights) $

On 11 August, SKC (KRX: 011790) announced that it will issue exchangeable bonds (EB) worth 125 billion won.

The exchange price is 114,714 won, which is a 14% premium to the reference stock price calculated based on the market price.

We are Negative on SKC’s EB issue of 125 billion won which is likely to put a negative sentiment on its share price.

🇰🇷 LG Chem: Flurry of Asset Sales Raises the Probability of A Partial Sale of LG Energy Solution (Douglas Research Insights) $

In the past three months, LG Chem (KRX: 051910 / 051915) has announced two asset sales worth 1.6 trillion won including dermal filler and water filter businesses.

Due to worsening balance sheet and need to raise additional capital, there is an increasing probability of LG Chem selling a partial stake in LGES in the next 6-12 months.

Our NAV valuation of LG Chem suggests implied NAV per share of 414,325 won, which is 49% higher than current levels.

🇰🇷 LS Corp: Treasury Share Cancellation of 171 Billion Won (Douglas Research Insights) $

On 12 August, LS Corp (KRX: 006260) announced that it will cancel 1 million treasury shares (171 billion won), representing 3.1% of its outstanding shares.

This is significant, especially because the company has not cancelled any shares in the past five years. This move signals the company’s willingness to provide greater returns to its shareholders.

LS plans to increase its dividend by at least 5% annually, to reach dividend payout of at least 30% by 2030.

🇰🇷 KT Corp: Excellent 2Q 2025 Earnings Driven by Market Share Gain and Improving AI/Cloud Businesses (Douglas Research Insights) $

The most important reason for KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC)‘s excellent results in 2Q 2025 was due to the major hacking incident at SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) in May 2025.

The company’s growing AI business and successful real estate sales also contributed to the company’s improving results in 2Q 2025.

KT is likely to benefit from higher profits and returns on capital in the next couple of years as the penetration of 5G service surpasses more than 80%.

🇰🇷 JYP Entertainment: Explosive Earnings Growth in 2Q 2025 (Douglas Research Insights) $

JYP Entertainment Corp (KOSDAQ: 035900) reported an explosive growth in sales and profits in 2Q 2025. It achieved sales of 215.8 billion won (up 125.5% YoY and 6.4% higher than consensus).

JYP also had an operating profit of 52.9 billion won (up 466.5% YoY and 23.3% higher than consensus in 2Q 2025.

JYP’s much better than expected results in 2Q 2025 confirms its ability to monetize the growing popularity of K-Pop globally.

🇰🇷 HMM: Tender Offer of 8% of Outstanding Shares and Cancellation (Douglas Research Insights) $

After the market close on 14 August, HMM (KRX: 011200) announced a tender offer of 81.8 million treasury shares (8% of outstanding shares).

An even bigger factor on HMM’s share price than this tender offer could be the continued decline in the global shipping rates which is negative on the company.

Overall, we would be cautious on HMM over the next one year. HMM also reported worse than expected operating profit in 2Q 2025 due to weaker global shipping rates.

🇰🇷 Webtoon Entertainment: Secures a Big Contract With Disney (Douglas Research Insights) $

Webtoon Entertainment Inc (NASDAQ: WBTN) has secured a big contract with The Walt Disney Co (DIS US) including Avengers and Spider Man to become available in webtoon format.

We believe Webtoon Entertainment could grab about 20% of the global market for webtoons in 2030 which would be about $4 billion in revenues.

Assuming a net margin of 10% and a P/E multiple of 20x, it suggests market cap of $8 billion for Webtoon Entertainment by 2030 (264% upside from current levels).

🇰🇷 Korea Small Cap Gem #43: Total Soft Bank (Douglas Research Insights) $

Total Soft Bank Ltd (KOSDAQ: 045340) is a Korean software company focused on digital solutions (enterprise industrial software, SaaS) for the maritime shipping and port logistics value chain.

The company had best ever results in 2Q25. It had sales of 9.7 billion won (up 140.6% YoY) and operating profit of 5.1 billion won (up 947% YoY) in 2Q25.

Using a P/E ratio of 15x on the estimated net profit of 15.5 billion won (2027E), it would suggest market cap of 233 billion won (207% higher than current levels).

🇰🇷 Coupang: Growing Confidence (Q2 Earnings Update) CPNG 0.00%↑ Chit Chat Stocks

Not enough praise can be heaped on Bom Suk Kim and his team.

I have felt this way about Nelnet for the last five years. In that time, the stock is up ~100% with minimal drawdowns. I do not worry about the position at all, even though it makes up 20% of my long portfolio.

Coupang, Inc. (NYSE: CPNG) is starting to feel similar. Its business is humming along beautifully, an orchestrated machine of commerce, delivery, and retail services that keep compounding in harmony.

Taiwan is growing revenue 54% quarter-over-quarter, and they expect even more acceleration in Q3. The country is ramping up quickly, meaning the Coupang playbook is working to attract customers, subscribers, and e-commerce spending.

🇵🇭 DigiPlus says 1H net income up 61pct y-o-y, flags tax contribution in the period (GGRAsia)

Philippine-listed licensed online gaming operator DigiPlus Interactive (PSE: PLUS) reported first-half net income up 60.9 percent year-on-year, at PHP8.40 billion (US$147.5 million) from PHP5.23 billion. Total revenues for the six months to June 30 rose 46.7 percent to nearly PHP47.78 billion, according to a Thursday filing.

The firm said that was supported by “increased business activity and the rollout of new games and licences” approved by the nation’s gaming regulator, the Philippine Amusement and Gaming Corp (Pagcor).

Most of DigiPlus’ first-half revenue, i.e., PHP47.19 billion, was from retail games.

In the Philippines, the firm is licensed to offer the digital entertainment platforms BingoPlus, ArenaPlus, and GameZone. Last month the company said it was “on track” to launch in September, online gaming services in Brazil. The brand said last month it aims to expand into South Africa.

🇸🇬 DBS: Best In-Class Bank In Asia (Seeking Alpha) $ 🗃️

🇸🇬 Shopee delivers a stellar quarter – but why no one asked about TikTok Shop?

Our thoughts on Sea Limited (NYSE: SE)’s Q2 2025 earnings

Shopee parent Sea Group’s Q2 2025 results, released on Tue 12 Aug 2025, obviously excited the investors.

With quarterly net income quintupling YoY to US$418.2 million, Sea Group (NYSE:SE) stock price rose 19.07% by the end of the trading day.

As usual, we’ll skip the boilerplate numbers you can find in media and analyst reports – and share 15 of our own observations instead:

🇸🇬 Sea Limited: Shopee Monetization Driving EPS Growth (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited’s Rally Still Has Legs – Growth Flywheel Accelerating (Seeking Alpha) $⛔🗃️

🇸🇬 Sea Limited: Soaring To New Levels (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Profitability Surge And GMV Acceleration (Rating Upgrade) (Seeking Alpha) $⛔🗃️

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Sea Limited (SE) Q2’25: ‘The Best Is Yet to Come’ – Profitable Growth In All Segments (Sleep Well Investments)

E-com GMV +29% YoY, Gaming +23%, Financial Services Loan Book up 90% (1% non-performing). Group revenue up 38%, operating profit ~$2B, FCF >$3B annualised. Cheap at ~26xEV/FCF for 20%+ LT growth.

Sea Limited (NYSE: SE), a 23% position in the Sleep Well Portfolio and a 55% position in my PA, has consistently seen the most additions to the portfolio whenever the market throws a discount [Jun 2024, Mar 2025, April 2025, July 2025].

After another solid quarter, I still see myself adding on the way up!

🇸🇬 GRAB Holdings Riding A 19% GMV Surge – Can Its Super App Ecosystem Keep Momentum Alive? (Smartkarma) $

Grab Holdings Limited (NASDAQ: GRAB) ’ second-quarter 2025 earnings reflected a mix of strong operational progress and notable challenges, painting a nuanced picture for investors evaluating the company’s prospects.

The quarter showcased impressive momentum in user engagement, with group Monthly Transacting Users (MTUs) continuing to rise and on-demand Gross Merchandise Value (GMV) posting 21% year-on-year growth in US dollar terms and 18% in constant currency.

This growth underscores the platform’s increasing utilization and the loyalty of its user base.

🇸🇬 A Deep Dive on Grab Holdings (GRAB) (RS Capital)

The Leading Superapp of Southeast Asia

Some investors outside of Asia might have never heard of Grab Holdings Limited (NASDAQ: GRAB) or might not fully understand what the company does, but for people in Southeast Asia, GRAB is a big deal. It has become an integral part of the Southeast Asian economy — it has become a way of living.

Fortunately, GRAB has garnered significant attention lately, particularly due to a few large accounts on X. Increased coverage of GRAB would demystify some of the misconceptions around the company. Some investors call it the “Uber of Southeast Asia” — but GRAB is more than that.

I’m doing my part as well by bringing to you this deep dive analysis on GRAB.

To set the scene, I’m Indonesian, and I use the GRAB app religiously, making at least one transaction daily. For that reason, you’re getting this deep dive article from the perspective of a heavy GRAB user, instead of some random analyst somewhere in the United States.

🇸🇬 Get Smart: STI smashes records. What happens next? (The Smart Investor)

Investors are in a celebratory mood as the Straits Times Index (SGX: ^STI) hit a new record recently. The bellwether blue-chip index surpassed 4,000 for the first time last month and has since broken past the 4,200 mark.

Along the way, DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) also hit a new milestone by briefly touching S$50 per share. This feel-good sentiment has pushed the share prices of many blue-chip companies to their 52-week highs.

Can this rally be sustained and will the STI break new records from here?

Earnings and dividend momentum

Better earnings, stronger dividends

The path is rarely a straight line

How we are navigating this market

🇸🇬 Webinar Recording: STI at New Highs: Can the index soar higher? (The Smart Investor) 1:01:13 Hours

The STI is at new highs, but can it last? Watch our webinar recording to get a strategic edge and navigate the opportunities and risks ahead.

In this webinar, our Co-Founders, Joanna Sng and Chin Hui Leong, teamed up with Portfolio Manager Royston Yang to give you the answers you’ve been searching for.

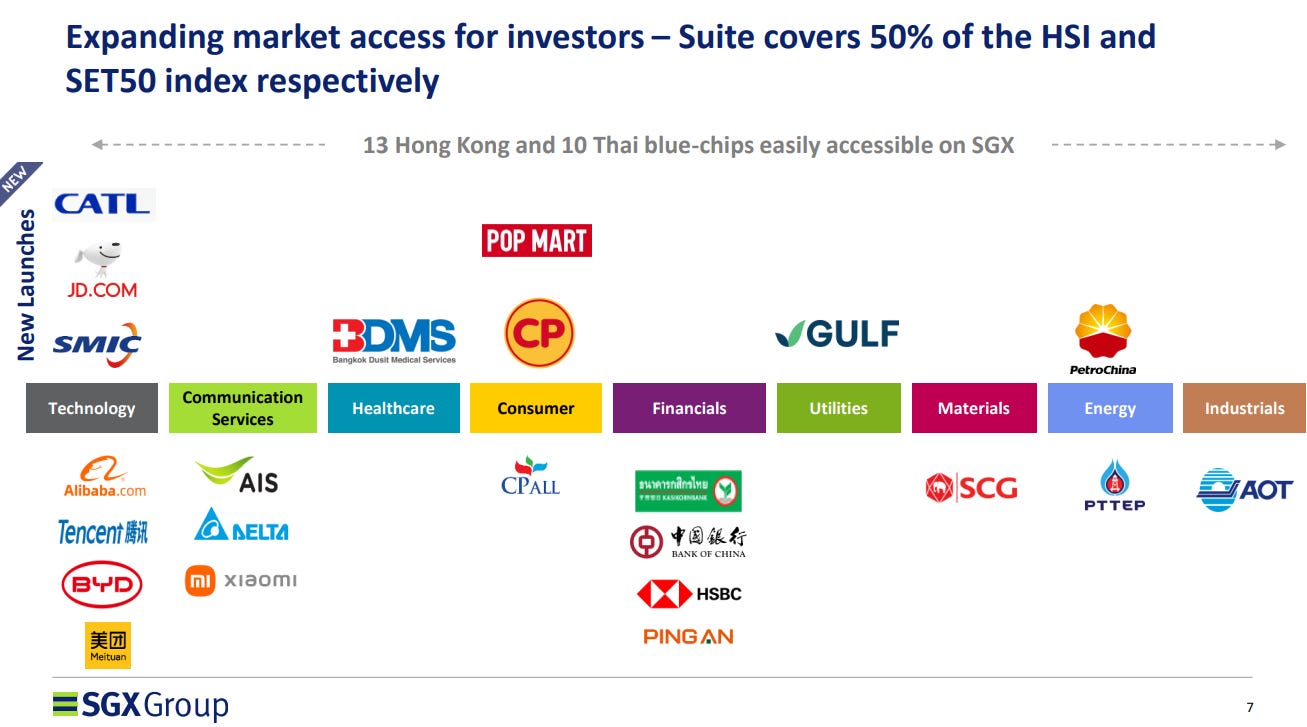

🇸🇬 SGX Added Two More Hong Kong Singapore Depository Receipts: Here’s What You Need to Know (The Smart Investor)

🇸🇬 Singapore’s Telco Consolidation: Who are the Winners and Losers (The Smart Investor)

Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) surprised the market this week when it announced the sale of telecommunication company (telco) M1 to Simba Telecom Pte Ltd.

The agreed transaction amount was S$1.43 billion, with Keppel receiving close to S$1 billion in cash for its 83.9% stake in M1.

Simba had put forth the most attractive bid among interested parties and is a unit of Tuas Ltd (ASX: TUA / OTCMKTS: TUALF), an Australian-based company that owns and operates mobile services and provides telecommunication services in Singapore.

Keppel, however, will book an estimated accounting loss of S$222 million but maintains that this transaction helps crystallise its investment in M1.

Just one day later, StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) announced the acquisition of the remaining 49.9% stake in MyRepublic that it does not own.

Singapore’s second-largest telco will pay S$105.2 million for the MyRepublic brand in Singapore, along with key operational assets relating to the broadband business.

Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel will face stronger competition in the postpaid sector as its current market share is close to 39%.

🇸🇬 5 Singapore Companies Made it to Forbes Asia “Best Under a Billion” List: Should You Add Them to Your Buy Watchlist? (The Smart Investor)

Forbes Asia recently released its 2025 “Best Under a Billion” list, which features 200 top-performing small and mid-cap firms across Asia.

Companies on this list have annual sales of more than US$10 million but less than US$1 billion.

A composite scoring system was used to rank the companies, with measures such as debt, sales, and earnings per share growth over one and three-year periods.

Return on equity for one and five years was also one of the factors.

Of these 200 companies, just five came from Singapore, and review them to determine if they should be included in your buy watchlist.

Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX, is Singapore’s sole stock exchange operator.

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) is a financial technology firm operating a platform that allows users to buy and sell equities, bonds, and unit trusts.

Centurion Corporation Ltd (SGX: OU8) is a provider of purpose-built worker accommodation (PBWA) and student accommodation (PBSA) assets in countries such as Singapore, Malaysia, China, and the UK.

Credit Bureau Asia Ltd (SGX: TCU), or CBA, is a provider of credit and risk information solutions to financial institutions, multinational corporations, and government agencies.

Grand Banks Yachts (SGX: G50), or GBY, is a manufacturer of luxury recreational motor yachts under the Grand Banks, Eastbay, and Palm Beach brands.

🇸🇬 4 Singapore Blue-Chip Stocks That You Can Own for Life (The Smart Investor)

🇮🇳 What falling out with the US means for India (FT) $ 🗃️

🇮🇳 ICICI Bank: Buy Amidst India’s Economic Expansion And Privatization Efforts (Seeking Alpha) $ 🗃️

🇮🇳 Closure of Short Call on Tata Motors (Smartkarma) $

Post Q4FY25 results, we had presented our case for shorting Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) in May 2025, anticipating a challenging quarter ahead. We now recommend closing the short position, with reasons explained in this insight

The company reported a very challenging Q1FY26, with JLR EBIT crashing to 4.0% (vs 8.9% YoY). The India passenger car business also faced similar pressure.

The only segment to deliver stable performance was the commercial vehicle division.

🇮🇳 The Beat Ideas: Edelweiss 2.0 – Unlocking Value Through Deleveraging and Strategic Listings (Smartkarma) $

Edelweiss Financial Services Ltd (NSE: EDELWEISS / BOM: 532922) plans a INR 1,500–2,000 crore IPO of EAAA and a 25–30% stake sale in its mutual fund arm to accelerate deleveraging.

These transactions could meaningfully reduce corporate debt from INR 6,325 crore, strengthen the balance sheet, and unlock shareholder value.

Successful execution improves capital efficiency, supports high-margin business growth, and enhances upside potential, reinforcing the 56% target price appreciation case.

🇮🇳 Beat Ideas: Jayaswal Neco; Potential Turnaround Bet on Deleveraging and Restructuring (Smartkarma) $

Jayaswal Neco Industries Ltd (NSE: JAYNECOIND / BOM: 522285) has transitioned from financial distress to operational momentum, with blast furnace upgrades completed, capacity ramp-up underway, and debt refinancing on the horizon.

Removal of ARC stake sale overhang and scope for capacity expansion strengthen the investment case.

If debt gets refinanced at 50% lower interest rate by Dec-25, it could double company’s PAT leading to potential re-rating

🇮🇳 Kalyan Jewellers: Deleveraging “Pause,” Capital Absorption Rising, Contrasting Capital Allocation (Smartkarma) $

Kalyan Jewellers India Ltd (NSE: KALYANKJIL / BOM: 543278)

Management has paused its previously articulated plan to reduce debt by INR 300–400 crore.

The pause defers balance‑sheet de‑risking and redirects internal cash toward a lean‑credit procurement pilot and a new regional‑brand roll‑out (inventory‑heavy upfront), raising working‑capital intensity just as gross‑margin mix is shifting.

Near‑term FCF could compress despite strong topline; margin delivery needs to outpace capital absorption to sustain the rerating. Market reaction (‑9% on the day) shows low tolerance for capital‑allocation ambiguity.

🇮🇳 Business Breakdown: CFF Fluid Control – In the Middle of India’s Naval Indigenization Drive (Smartkarma) $

[Defence solutions for ships and submarines] CFF Fluid Control Ltd (BOM: 543920) enters FY25 with a INR 500+ crore order book and expanded manufacturing capacity at Khopoli and upcoming Chakan facility.

Strategic partnerships, high entry barriers, and preferred supplier status strengthen revenue visibility amid India’s naval indigenization push.

Robust growth prospects and contract pipeline outweigh concentration risks, reinforcing a positive long-term outlook.

🇮🇳 Goldiam International: Riding on Lab-Grown Exports Despite Tariff Uncertainty (Smartkarma) $

Goldiam International Ltd (NSE: GOLDIAM / BOM: 526729) reported its highest-ever Q1 results, with sales increasing by 39% year-on-year (YoY) and 17% quarter-on-quarter (QoQ).

The most standout update from the company is that it has able to pass on additional tariffs to US consumers despite a muted demand environment

Company is now raising growth capital of close to INR 250 crores via QIP and also expanding its backward integration, which will improve its performance further

🇮🇳 PG Electroplast: Guidance Cut Tempers Near-Term Outlook, Valuation Back in Check? (Smartkarma) $

[Electronics Manufacturing Services] PG Electroplast Ltd (NSE: PGEL / BOM: 533581) cut FY26 guidance sharply, triggering ~30% share price fall. Valuations now near long-term medians, with EV/EBITDA at 26.8x and P/E at 54x.

Near-Term growth headwinds emerge, but Indian RAC market’s 18% CAGR outlook remains intact, supported by low penetration, rising incomes, and PLI-led domestic manufacturing push.

Correction offers fair-value entry. Long-term thesis intact with PGEL’s EMS leadership, backward integration, and exposure to fast-growing consumer durable categories.

🇮🇱 Tower Semiconductor: Capitalizing On AI Demand Is Key (Seeking Alpha) $ 🗃️

🇮🇱 Teva’s ($TEVA) continued resurgence (Kontra Investments)

Strategic pivot to growth and value

It has been a busy couple of weeks in global healthcare, predominately with negative news but Teva Pharmaceutical Industries Ltd (NYSE: TEVA) just quietly delivered its 10th consecutive quarter of growth, raised guidance across its key innovative drugs, slashed debt again, and trades at 6x earnings. The market is still mostly asleep on this one. The setup here? Multiyear transitioning from legacy generics to an innovation-driven cash machine—with a pipeline that could blow expectations wide open. If you’re not looking at Teva, you’re missing one of the cleanest turnaround stories in global pharma. Let´s dive in!

🇿🇦 Gold Fields: Downgrading To Hold After A Golden Run (Seeking Alpha) $ 🗃️

🌐 Gold Fields (JSE: GFI / NYSE: GFI) – One of the world’s largest gold mining firms. 9 operating mines in Australia, Peru, South Africa & Ghana (including the Asanko JV) & 2 projects in Canada & Chile. 🇼 🏷️

🌎 Tenaris: Recession-Resistant, Globally Diversified, And Cheap (Seeking Alpha) $ 🗃️

🌎 Arcos Dorados Comparable Sales Growth Do Not Reflect The Deteriorating Business (Seeking Alpha) $ 🗃️

🌎 Arcos Dorados Holdings Inc (NYSE: ARCO) – World’s largest independent McDonald’s franchisee. Exclusive right to own, operate & grant franchises of McDonald’s restaurants in 20 Latin American & Caribbean countries & territories. 🇼 🏷️

🌎 DLocal: Why The Stock Still Looks Attractive After Q2 Rally (Seeking Alpha) $⛔🗃️

🌎 DLocal (DLO): Q2 2025 Earnings Review (M. V. Cunha’s Substack)

Yesterday, Dlocal (NASDAQ: DLO) reported its Q2 2025 results.

The stock is up over 20% after a significant beat across the board, and I couldn’t be happier as a shareholder.

In this article, I’ll break down everything you need to know from the Earnings Report.

🌎 Ignore the EPS Miss — MercadoLibre’s Long-Term Thesis Has Never Looked Better

Revenue is surging, user growth is accelerating, and its moat is only getting deeper!

On Monday, MercadoLibre (NASDAQ: MELI) released its second-quarter results, which seemed a bit mixed at first glance, as MELI beat the revenue consensus but missed the bottom-line estimate. Initially, this led to a 5%+ sell-off in after-hours trading, but soon enough, investors realized that the headline numbers don’t tell the entire story. Crucially, MELI’s top-line growth held up exceptionally well, its underlying metrics (user growth and engagement) continued to grow strongly, it continued to gain market share, and while cash flows missed estimates, this was driven mainly by FX fluctuations and not actual business performance.

In other words, MELI delivered an excellent quarter, which is precisely why shares gained 0.5% in the open market trading session the next day, and rightfully so.

In order to find out, let’s review the Q2 results before updating my financial estimates and considering valuation.

🇦🇷 Legislative Elections on the Horizon and Bull Market Continuation (TheOldEconomy Substack)

August LatAm Report: The Argentinean Edition

The Argentine market may soon enter its third bull leg. The first one preceded Milei’s victory, and the second one followed. Positive political, economic, and financial catalysts are building up, which will reignite investors’ interest.

First, the political highlight of 2025. On October 26, Legislative Elections are scheduled. The polls are suggesting a landslide victory for Javier Milei’s party, La Libertad Avanza.

During the first legs of the bull run, the fastest horses were:

🇦🇷 Cresud: Excellent Real Estate Business And A Positive Outlook (Seeking Alpha) $ 🗃️

🇧🇷 Ten points on the US vs Brazil feud (Latin America Risk Report)

Trump, Bolsonaro, and Lula all have political incentives to keep the feud going. The question is how far they will escalate.

🇧🇷 StoneCo: Focused And Disciplined, Trading At A Discount, With EPS Growing Fast (Seeking Alpha) $⛔🗃️

🇧🇷 Nu Holdings Is Still Early In Its Growth Trajectory (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Still Misunderstood Following Strong Q2 (Seeking Alpha) $ 🗃️

🇧🇷 Nu Q1 2025 Earnings Update! (Global Equity Briefing)

Strong Customer Gains, Exploding Deposits, and Affordable Valuation!

Nu Holdings (NYSE: NU) is a disrupting company operating in a large, dynamic, and volatile region. While this makes them an extremely exciting investment, it also makes Nu difficult for Wall Street to understand.

Last quarter, Wall Street panicked, sending the stock down 8% after earnings.

Why, you ask?

🇧🇷 Suzano: Capturing High Yields Ahead Of A Pulp Recovery (Seeking Alpha) $ 🗃️

🇧🇷 Afya’s Multiple Is Back To Reasonable Levels, But Market Saturation Is Real (Seeking Alpha) $⛔🗃️

🇧🇷 Banco do Brasil Q2: Another Troubling Quarter (Seeking Alpha) $⛔🗃️

🇧🇷 Vasta’s Higher Price Is Fair Given Market Improvements (Seeking Alpha) $⛔🗃️

🇧🇷 Vasta Platform Limited (NASDAQ: VSTA) – High-growth education company providing end-to-end educational and digital solutions for private schools operating in the K-12 educational segment. 🏷️

🇧🇷 Sabesp Q2: Not Even The Most Optimistic Investor Expected This Result (Seeking Alpha) $ 🗃️

🇧🇷 Ambev: 7% Yield, Rock-Solid Balance Sheet, And 30% EBITDA Margins (Seeking Alpha) $⛔🗃️

🇧🇷 Itaú Q2: Excellent Result And Reiterated Recommendation (Seeking Alpha) $ 🗃️

🇧🇷 Vinci Compass Remains Stagnant, But LatAm Markets Are Moving (Seeking Alpha) $ 🗃️

🇧🇷 Vinci Partners Investments Ltd (NASDAQ: VINP) – Alternative investments platform. Specialized asset management, wealth management & financial advisory services to retail + institutional clients in Brazil. 🏷️

🇧🇷 Inter Q2: On Track To Meet 2027 Targets (Seeking Alpha) $ 🗃️

🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 B3 Is Not Growing During The Most Challenging Part Of The Cycle, But Remains A Buy (Seeking Alpha) $ 🗃️

🇧🇷 Banco Bradesco Is Growing In Rural And SME Into A Credit Tightening Cycle (Seeking Alpha) $⛔🗃️

🇧🇷 Gerdau: A More Bullish Outlook Ahead Of H2 (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Financial Strength Intact Despite No Extra Dividends (Seeking Alpha) $⛔🗃️

🇨🇱 Compania Cervecerias Unidas Trend Is Improving In Chile But The Name Is Very Expensive (Seeking Alpha) $ 🗃️

🇨🇴 Grupo Cibest: Best In Latin America (Seeking Alpha) $ 🗃️

🌎🅿️ Grupo Cibest SA (NYSE: CIB / BVC: PFBCOLOM) fmr. Bancolombia – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇲🇽 Grupo Aeroportuario del Centro Norte: Commercial Revenues Are Booming (Seeking Alpha) $ 🗃️

🇵🇦 I Was Wrong On Bladex, And The Name Still Has Value (Seeking Alpha) $⛔🗃️

🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🌐 220 Years of History: Best and Worst Investments to Build Wealth (The Pareto Investor)

From stocks to gold, bonds, real estate, and Bitcoin — here’s what 220 years of data reveal about long-term investing.

🌐 Nebius Group (NBIS): Q2 2025 Earnings Review (M. V. Cunha’s Substack)

Today, Nebius Group NV (NASDAQ: NBIS) released its Q2 2025 results.

As of writing, the stock is up over 20% after beating expectations and raising guidance.

It’s the largest position in my portfolio, so I couldn’t be happier.

In this article, I’ll break down everything you need to know about the Earnings Report.

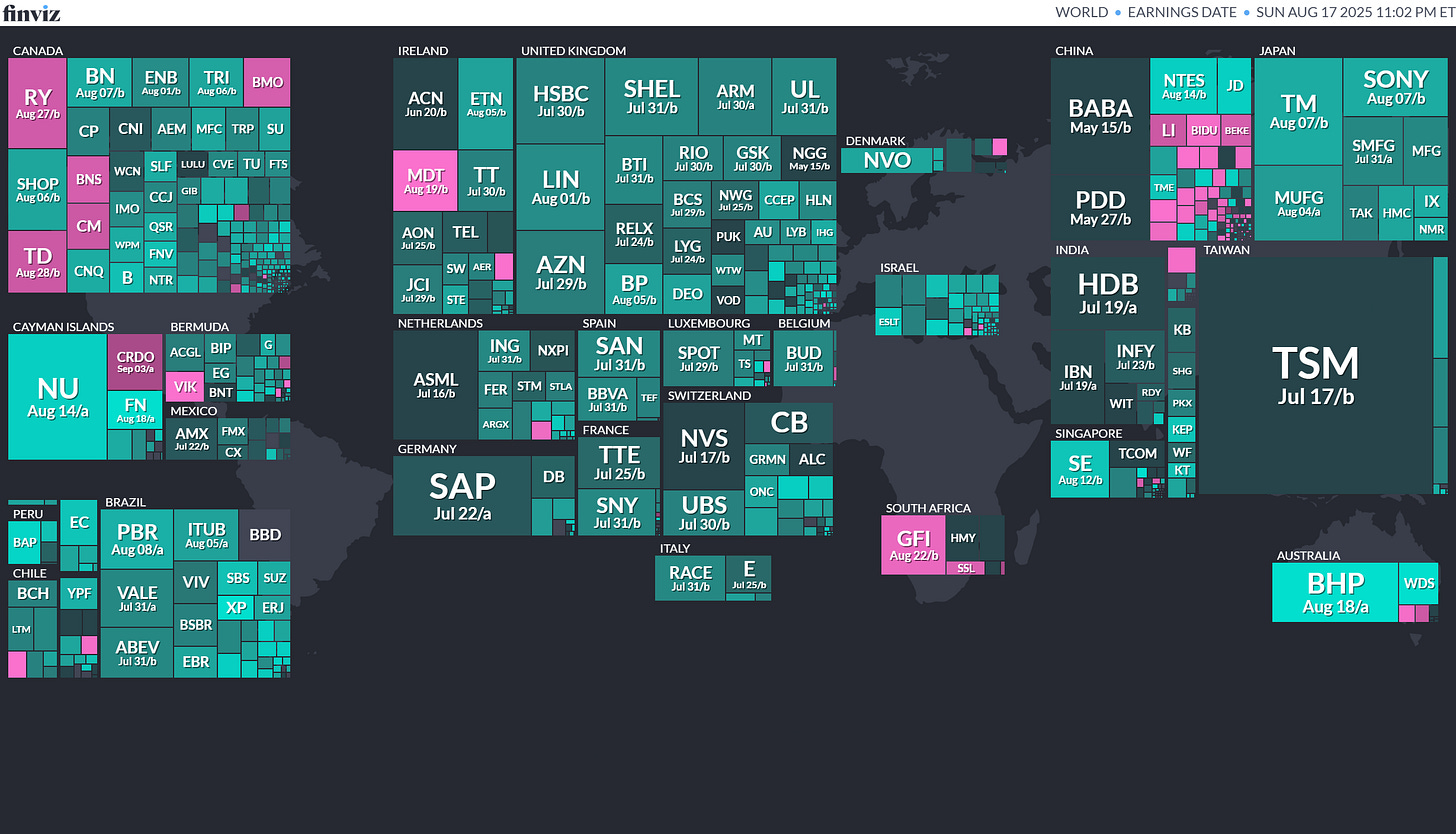

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

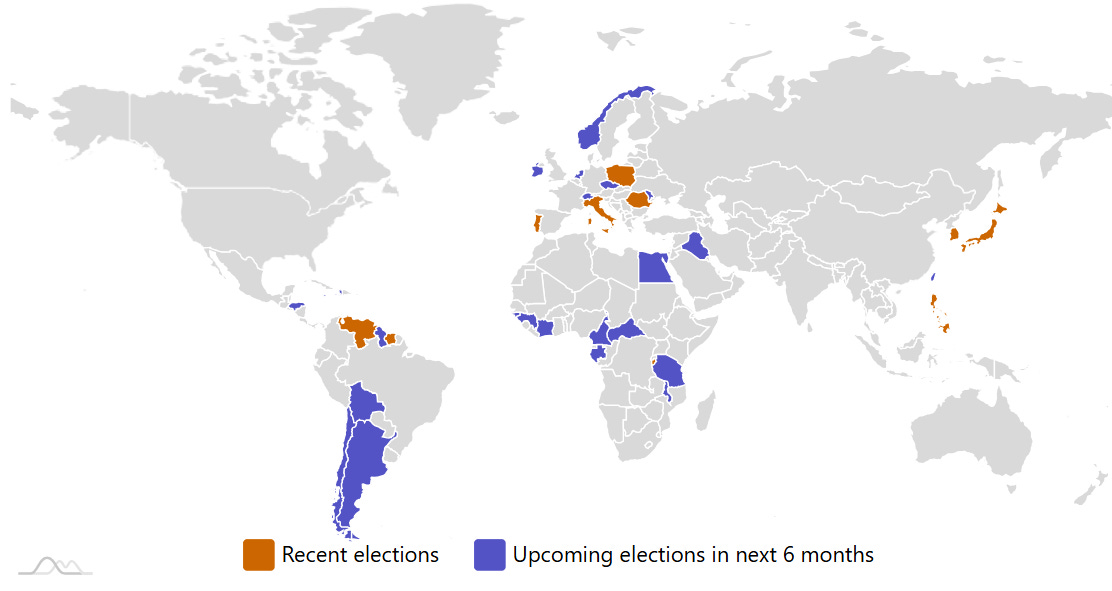

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

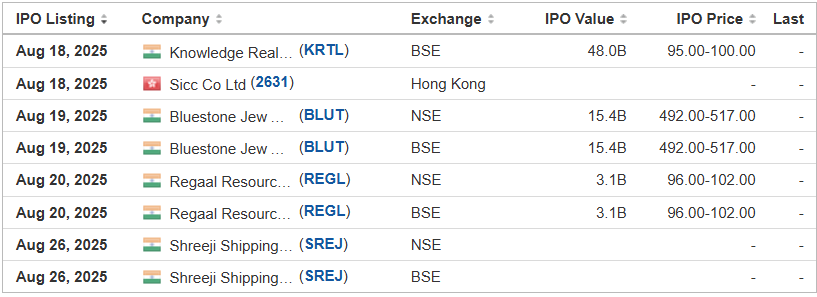

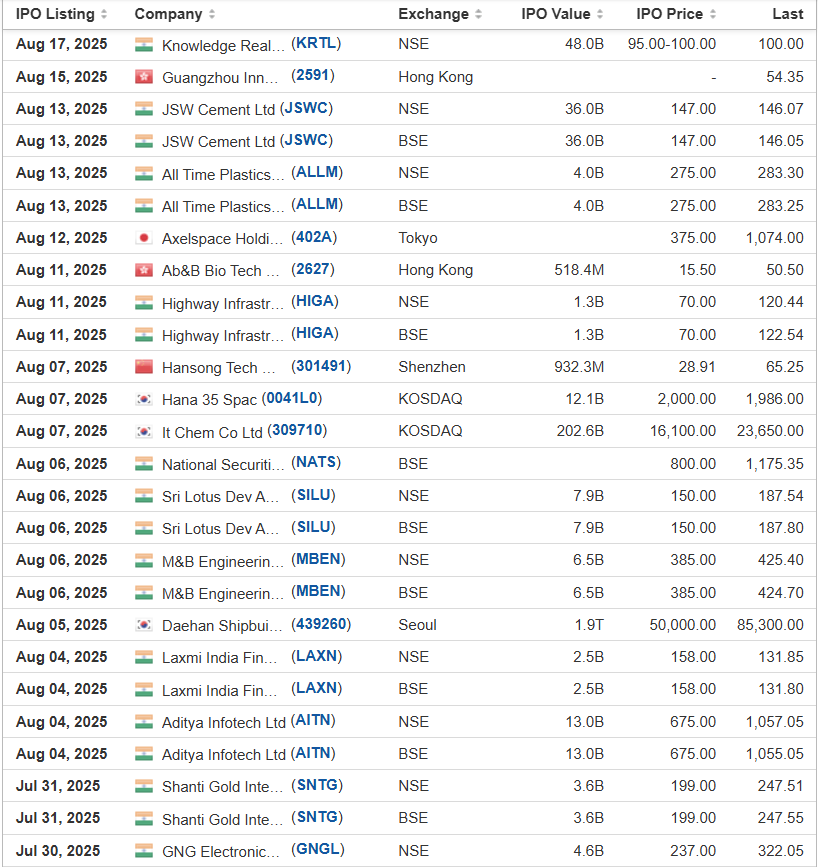

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

NusaTrip Inc. NUTR Cathay Securities, 3.8M Shares, $4.00-4.00, $15.0 mil, 8/15/2025 Priced

We are an online travel agency based in Jakarta, Indonesia. We specialize in Southeast Asia. We are being spun out of Society Pass. (Incorporated in Nevada)NusaTrip’s mission is to become the Premier Travel Hub in Southeast Asia.Established in 2015 and headquartered in Jakarta, Indonesia, NusaTrip is a travel ecosystem with geographical specialization in Southeast Asia (SEA) and Asia-Pacific (APAC). NusaTrip is an acquisitions-focused company. Mergers and acquisitions (M&A) of offline travel agencies play a pivotal role in our growth strategy. We have demonstrated an ability to execute accretive and synergistic acquisitions as well as integrate and fundamentally improve our acquired businesses. We have completed acquisitions of VLeisure and VIT, both travel companies in Vietnam. We will continue to focus on the acquisition of other synergistic companies, and we are currently looking to acquire travel agencies operating in PRC, Hong Kong, Philippines, Thailand, Singapore, Malaysia, India, and UAE. As of the date of this prospectus, we have no current mergers or acquisitions pending or contemplated. We aim to bring travelers from the rest of the world to SEA and APAC (inbound travel) and bring travelers from SEA and APAC to the rest world (outbound travel).In August 2022, NusaTrip officially joined the Society Pass Inc. (Nasdaq: SOPA) ecosystem when SOPA acquired 75% of the outstanding capital stock of Nusatrip International Pte Ltd. and also purchased all of the outstanding capital stock of PT Tunas Sukses Mandiri, a company existing under the law of the Republic of Indonesia. Both of the acquired companies engage in online ticketing and reservation services. In May 2023, SOPA incorporated Nusa Trip Incorporated and SOPA transferred its ownership of the acquired companies to NusaTrip Incorporated.Note: Net loss and revenue are in U.S. dollars for the 12 months that ended March 31, 2025.(Note: NusaTrip Inc. priced its small IPO at $4.00 – the low end of its range – and sold 3.75 million shares – the number of shares in the prospectus – to raise $15 million on Thursday night, Aug. 14, 2025. Background: NusaTrip Inc. increased its IPO’s size to 3.75 million shares – up from 3.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $16.88 million, it the deal is priced at $4.50, the mid-point of its range, according to an F-1/A filing in April 2025. Background: NusaTrip Inc. revived its IPO – a day after withdrawing it – with the filing of an F-1 on March 21, 2025, in which it disclosed the terms: 3.0 million shares at a price range of $4.00 to $5.00 to raise $13.5 million.)(Background – Withdrawn IPO: NusaTrip Inc. withdrew its plans for its IPO in a letter to the SEC dated March 20, 2025; the terms called for NusaTrip Inc. to offer 2.7 million shares at a price range of $4.00 to $5.00 to raise $12.15 million. Background: NusaTrip Inc. filed its F-1 to go public in November 2024.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), 1.7M Shares, $4.00-6.00, $8.5 mil, 8/18/2025 Week of

(Incorporated in the Cayman Islands)We are a manpower service provider based in Singapore. Manpower service providers (“MSP”) serve as a bridge between job seekers and businesses to meet each other’s recruitment needs. Typically, MSPs create a platform whereby employers can list job opportunities and recruit individuals looking to secure full, temporary or part-time employment meeting their respective criteria. For companies, MSPs assist the recruitment process to meet particular staffing needs, saving companies time, money, and effort. For job seekers, MSPs help them find an appropriate job matching their skill sets as quickly as possible, and exposing them to more opportunities through their vast network.Our customers fall into a wide range of industries, including warehouse and logistics, food and beverage, cleaning, manufacturing, retail and events. To provide better service to our customers, we pay close attention to the changing needs of our customers, including new developments in their respective industries, which helps us anticipate the specific roles and skills that they will need. We believe this attention to detail gives us a significant competitive advantage and improves customer loyalty.We have developed a proprietary platform which connects job seekers and employers through a unique matching program utilizing specific character and skill recognition matrices. Our platform operates a comprehensive database that records the skill preferences and requisite applicant characteristics of our business customers and job criteria of job seekers, thereby reducing reliance on subjective human analysis which can be extremely time consuming and inefficient. While many MSPs offer similar services, we believe our model is more specifically focused on our customers’ individual criteria, therefore we tend to deliver a more tailored approach, rather than providing a one-size-fits-all service.Job Seekers – We believe we stand out to job seekers in two important ways: (i) we have developed a mobile app to enable clients real-time access to the data and therefore opportunities, and (ii) we are the first manpower provision company operating with an app platform in Singapore that is compensating part-time workers on the very same day they finish their jobs.We have artificial intelligence (“AI”) technology integrated into our “EL Connect App” to create a positive user-friendly experience for part-time job seekers.Employers – For employers, in addition to the EL Connect App, we have also developed our “Taskforce App.” Our TaskForce App is a smart platform to digitalize building and property operations management. Our TaskForce App integrates internet of things (“IoT”) sensors, facial recognition systems and robotics into facilities and workforce management in buildings and properties. TaskForce App bridges the gap between the employees of our customers, such as site supervisors who oversee property management, and contractors or crews of our customers, who perform individual duties and tasks, addressing inefficiencies in traditional and paper-based processes of property management. Our TaskForce App seeks to achieve optimal performance and productivity for our customers by enabling their employees to have real-time monitoring of facilities and workforce management and providing them instant access to a variety of information ranging from attendance records of contractors or crews to real-time usage of consumable supplies in a facility. This has become an invaluable tool to our customers which has prompted us to monetize its application by opening it up to customer subscriptions and licensing, which we expect will become a growing revenue stream.We derive our revenue primarily from the following sources: (i) manpower supply services – which provides part-time manpower to customers on our employment and recruitment portal “EL Connect Mobile”; (ii) manpower contracting services – which provides cleaners for cleaning services; (iii) software as a service (“SaaS”) sales, which grants users the right to access our “Taskforce” app; (iv) software licensing sales, which grants clients the right to use the Taskforce app customized to their specific requests (updates and maintenance included); and (v) project management services.Note: Net income and revenue are in U.S. dollars for the fiscal year that ended June 30, 2024.(Note: ELC Group Holdings Ltd. increased its IPO’s size to 1.7 million shares – up from 1.25 million shares – and kept the price range at $4.00 to $6.00 – to raise $8.5 million. Background: ELC Group Holdings Ltd. disclosed the terms for its small IPO – 1.25 million shares at a price range of $4.00 to $6.00 – to raise $6.25 million, if priced at the $5.00 mid-point of its range, according to an F-1/A filing dated June 27, 2025. Initial Filing: ELC Group Holdings Ltd. filed its F-1 on March 4, 2025.)

Hang Feng Technology Innovation Co., Ltd. FOFO Kingswood, 1.4M Shares, $4.00-4.00, $5.5 mil, 8/18/2025 Week of

(Incorporated in the Cayman Islands)We are committed to providing comprehensive corporate management consulting and asset management services, tailored to address the specific needs of each client. Our goal is to empower our clients to design, implement, and achieve their unique business and investment objectives.Incorporated as an exempted company with limited liability in the Cayman Islands on October 15, 2024, we operate as a holding company with no material operations. Since 2023, we have been identifying market opportunities and offering consulting services through Starchain to a growing network of clients. Through the corporate management consulting practice, Starchain built strong relationships with clients, advising them on operational and strategic challenges. This privileged access has revealed a recurring need for sophisticated asset management solutions, tailored for both corporate and personal capital and the struggle to find trusted partners. Recognizing this gap, our management team strategically refined our business strategy to include a complementary asset management arm. Starting in 2024, we began offering asset management services through HF CM, HF IAM and HF Fund SPC.As of the date of this prospectus, all our business activities are conducted through our direct and indirect wholly owned subsidiaries. Our business consists of two main segments: (i) corporate management consulting services and (ii) asset management services.Note: Net income and revenue are in U.S. dollars for the 12 months that ended Dec. 31, 2024.(Note: Hang Feng Technology Innovation Co., Ltd. is offering 1.375 million shares at an assumed IPO price of $4.00 to raise $5.5 million, according to its F-1/A filing dated July 25, 2025.)

Phaos Technology (Cayman) Holdings Ltd. POAS Network 1 Financial Securities, 2.7M Shares, $4.00-5.00, $12.2 mil, 8/25/2025 Week of

We are an investment holding company; through our subsidiary, we assemble and commercialize advanced microscopy-related solutions, technologies and products. (Incorporated in the Cayman Islands)Using its patented microsphere-assisted technology, the company can significantly increase the magnification of an existing traditional optical microscope compared to its competitors, hence allowing our clients to see beyond the optical limit in an effective manner. Currently, it is the only commercially available advanced optical microscope that can see below the 200nm optical limit, within a commercially viable working distance.Our business is primarily involved in the assembling and commercialization of advanced microscopy-related solutions, technologies and products tailored for precision measurement and magnification purposes. Our range of product includes optical microscopy solutions, featuring:i)Super-resolution imagers capable of achieving imaging down to 137nm;ii)Specialized microscopes designed to meet the diverse needs of various industries; andiii)Three-dimensional (“3-D”) real-time image magnifiers for enhanced visualization.Traditional optical microscopes are able to see up to 250nm, while our solution allows users to see up to 137nm. As a result, we believe that this is considered by the optical industry as a super resolution optical microscopy solution.In addition to our hardware offerings, we currently provide complimentary proprietary software, which is developed in-house. This software includes Artificial Intelligent (“AI”) components that allows our customers to perform recognition patterns for research, quality assurance and quality control (“QA/QC”), as well as diagnostics purposes. The in-house software is meticulously crafted to complement our product line ensuring seamless integration and optimized performance for our customers.For the financial years ended April 30, 2023, and April 30, 2024, the provision of microscopy products contributed to 73.9 percent and 97.6 percent of our revenue, respectively.We distribute our microscopy products with software solutions through an extensive network of distributors, primarily in Singapore and expanding across regions such as Southeast Asia and South Asia. Our microscopy solutions accommodate a diverse range of applications enabling us to serve a wide range of customer needs and capitalize on emerging growth opportunities in the region. Our diverse customer base primarily includes industries with usage in fields such as manufacturing, research & development, biomedical, semiconductors, Printed Circuit Board (“PCB”), electronics, precision engineering, injection molding, research, healthcare, QA/QC and diagnostics. Our business strategic focus involves strengthening our market position in Singapore and progressively expanding into the Southeast Asian region.Note: Net loss and revenue are in U.S. dollars for the fiscal year that ended April 30, 2024.(Note: Phaos Technology (Cayman) Holdings Ltd. filed its F-1 on Jan. 3, 2025, and disclosed the terms for its micro-cap IPO – 2.7 million shares at a price range of $4.00 to $5.00 to raise $12.15 million, if the IPO is priced at the $4.50 mid-point of its range. Following up: On March 28, 2025, in an F-1/A filing, Phaos Technology (Cayman) Holdings Ltd. disclosed that selling stockholders would offer 900,090 shares – in addition to the 2.7 million shares that Phaos Technology is offering – at the price range of $4.00 to $5.00. The company will not receive any proceeds from the sale of the selling stockholders’ shares, according to the prospectus.)

PomDoctor POM Joseph Stone Capital/Uphorizon, 5.0M Shares, $4.00-6.00, $25.0 mil, 8/25/2025 Week of

We run an online platform in China to provide chronic disease management services. (Incorporated in the Cayman Islands)As of Dec. 31, 2024, PomDoctor had over 212,800 doctors (under contract) who had issued about 3.13 million prescriptions. The company had 699,000 patients (also referred to as transacting patients) as of Dec. 31, 2024.Our mission is to provide effective prevention and treatment solutions to alleviate patients’ suffering from illnesses.Our vision is to become the most trustworthy medical and healthcare services platform.We are a leading online medical services platform for chronic diseases in China, ranking sixth on China’s Internet hospital market measured by the number of contracted doctors in 2022, according to Frost & Sullivan.With focuses on chronic disease management and pharmaceutical services, our business model forms a one-stop platform for medical services, which organically connects patients to doctors and pharmaceutical products. Our experience in tackling chronic diseases can be traced back to 2015 when we launched our platform on mobile devices. We strategically chose to focus on this field because chronic diseases last at least one year by definition, and they are hard to cure, prone to complications and require ongoing medical attention. As such, patients with chronic diseases have a great and relatively inelastic demand for frequent and repeat follow-up visits and of drug purchases, which gives a competitive advantage to platforms that are able to maintain long-term, stable doctor-patient relationships.Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the year that ended Dec. 31, 2024.(Note: PomDoctor disclosed its IPO’s terms in an F-1/A filing dated July 15, 2025: The company is offering 5.0 million American Depositary Shares (ADS) at a price range of $4.00 to $6.00 to raise $25 million, if the IPO is priced at the $5.00 mid-point of its range. Background: PomDoctor filed its F-1 on March 13, 2025, without disclosing the terms for its IPO. and disclosed the terms for its IPO.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

04/02/2025 – Goldman Sachs India Equity ETF – GIND

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

02/14/2025 – GMO Beyond China ETF – BCHI

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (August 18, 2025) was also published on our website under the Newsletter category.