SBI Card and Flipkart have launched a new co-branded credit card that gives cashback and few additional benefits on Flipkart, Myntra, and Cleartrip.

The Flipkart SBI card is almost identical to the existing Axis Flipkart Card which is a co-brand credit card with Axis Bank launched almost 6 years ago.

Features & Benefits

Joining/Annual Fee: 500 INR+GST

Welcome Benefit: 250 INR Flipkart Voucher

Limited Period Offer: Additional 500 INR Flipkart Voucher

7.5% Cashback on Myntra

5% Cashback on Flipkart

5% Cashback on Cleartrip

4% Cashback on Zomato, Uber, PVR and Netmeds

Cashback Capping: 4,000 INR per Quarter (per category, as above)

1% Cashback on other spends without capping.

As you can see, the benefits and capping are almost identical to the Axis Flipkart Card except few variations like the different preferred partners for 4% cashback.

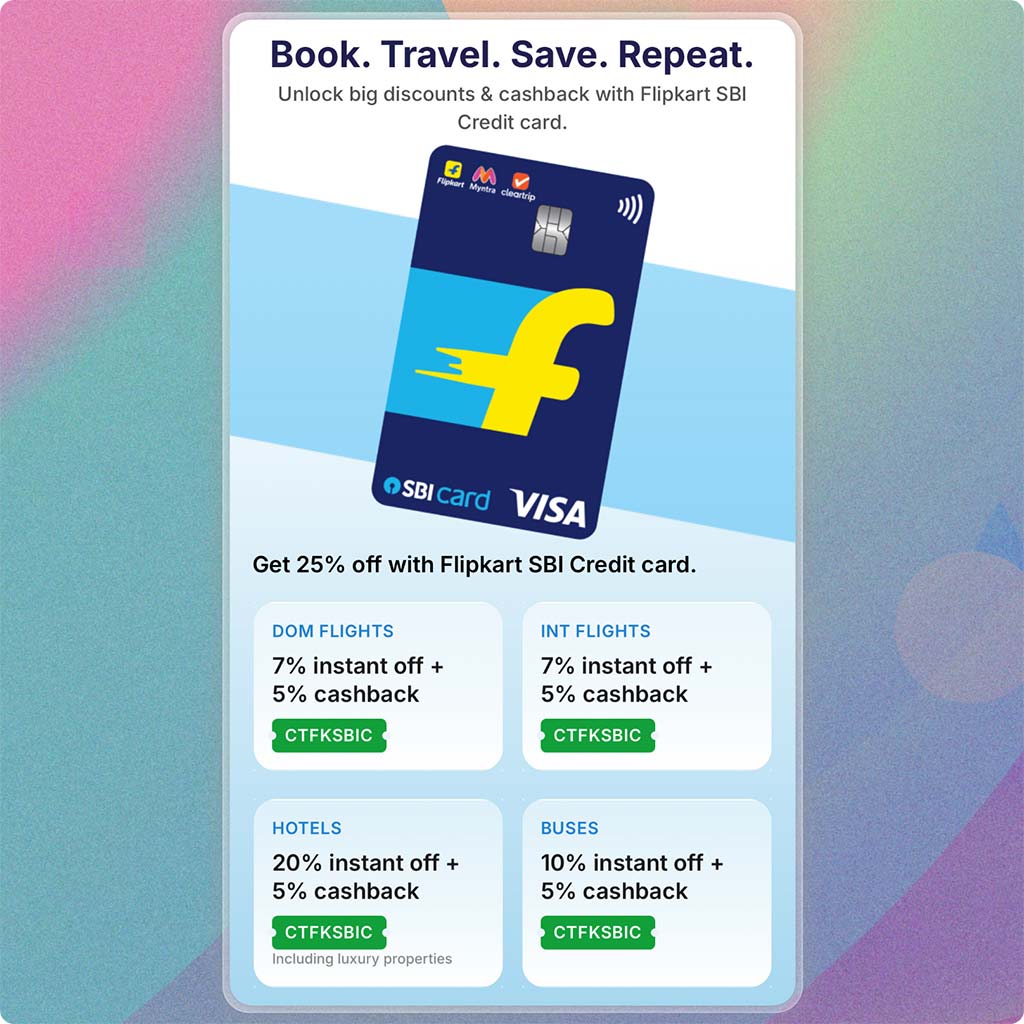

That aside, the card also has additional benefits on Cleartrip similar to the Axis variant, as you can see blow:

The Flipkart SBI card is available on both Visa and Mastercard, and the application system currently seems to issue Mastercard variant by default, as of now. You may apply on Flipkart app or on SBICard portal.

Is it worth it?

No, in most cases!

SBI Card already has two strong cashback products: the regular Cashback Card and the newly launched PhonePe Black Card.

Of the two, the Cashback SBICard stands out as one of the best in the segment, offering 5% cashback across most online merchants with a much higher monthly cap compared to the Flipkart cards.

So there is no point in applying for the Flipkart Card with SBI or even with Axis Bank in its current form.

If you’re still interested in the card, maybe for the Myntra benefit, it’s better to go for the Axis variant instead, perhaps after having a look at the detailed review of Axis Flipkart card.

Bottom line

While it’s always nice to see new credit card launches, it’s disappointing to see the same value proposition being repeated across banks for co-branded cards.

This trend isn’t just limited to Flipkart cards, even other co-brand cards like the Indigo cards follow the same pattern lately.

It would have been great to see some variation, like how the Vistara co-branded cards used to offer different benefits depending on the issuing bank.