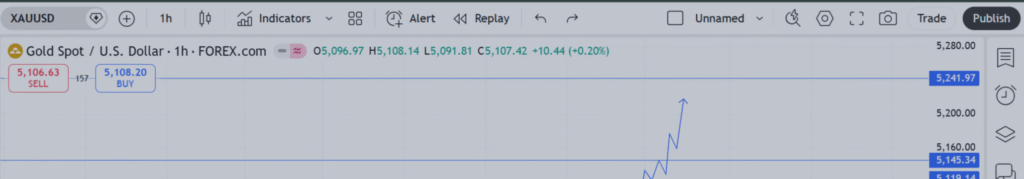

As we head into Monday’s session, Gold remains in a strong intraday bullish structure on the 1-hour timeframe.

After consolidating around the 5,000 region, price has broken into expansion mode and is now trading near 5,107–5,120 resistance.

This is not random volatility — this is structured momentum.

🔎 Current Market Structure (1H)

Clear sequence of higher highs and higher lows

Strong impulsive leg from 5,020 region

Clean breakout above prior consolidation

No confirmed bearish structural shift

The market has transitioned from accumulation to expansion.

🔑 Key Levels for Monday

🔹 Resistance: 5,119

This level has already been tested.

If Monday opens above 5,110 and holds:

→ Expect continuation toward 5,145.

🔹 Major Target: 5,145

If price breaks and sustains above 5,145:

→ Next projected expansion: 5,180–5,200.

🔹 Critical Support: 5,090

This is the “line in the sand.”

As long as hourly candles close above 5,090:

→ Bias remains bullish.

A strong close below 5,090:

→ Opens corrective move toward 5,060 liquidity zone.

🔥 Monday Scenarios

🟢 Bullish Continuation

Hold above 5,100

Strong hourly close above 5,119

Momentum candles without heavy wicks

Targets:

5,145 → 5,180

🔴 Controlled Pullback

Failure to hold 5,100

Break below 5,090

Targets:

5,060 → 5,030

This would be a healthy retracement, not a full trend reversal.

📊 Professional Insight

There is no confirmed distribution yet.

No lower highs.

No structural breakdown.

No heavy rejection.

Trend is strong but slightly extended.

Monday will likely start with:

• Liquidity sweep → continuation

or

• Direct breakout continuation

Avoid chasing impulsive candles.

📊 Detailed chart explanation is shared in my channel.

Follow the channel for daily professional analysis and structured market updates.

Channel: https://www.mql5.com/en/channels/learning-forex-gold