The use of reputational risk by bank supervisors was a problem the Federal Reserve Board came to understand only over the past couple of years, which is why the agency decided this week to remove it from bank examinations, Fed Chairman Jerome Powell said today.

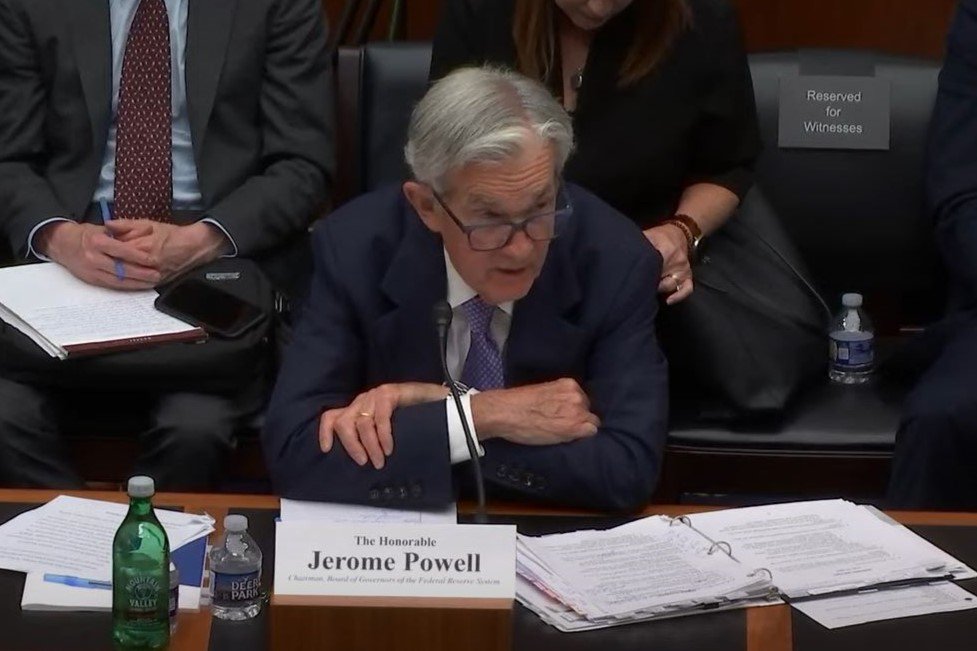

During his semiannual report before the House Financial Services Committee, Powell fielded questions from lawmakers on a variety of monetary and policy issues. Rep. Bryan Steil (R-Wis.) asked Powell why the Fed announced yesterday that it will remove references to reputation and reputational risk from its supervisory materials. Reputational risk has become a controversial component of bank supervision among lawmakers, who accuse regulators of using it to pursue political agendas.

“We’re hearing a lot of reports of debanking and that sort of thing,” Powell said. “And over the course of 2024, we came to the view that this is a serious problem that we need to address. We said that publicly and now we’re doing this, and so are the other agencies.”

The Office of the Comptroller of the Currency in March announced it was removing reputational risk from its examinations and guidance, and the FDIC is reportedly drafting rulemaking to do the same.

Powell also was asked about past actions by bank regulators that discouraged bank engagement with cryptocurrencies and other digital assets. He said the Fed’s view is that banks should be the ones to decide who their customers are.

“That is not our decision,” Powell said. “Banks are free to provide banking services to the crypto industry and crypto companies, and banks are also free to conduct crypto activities as long as they do so in a way that is protective of safety and soundness.”

Leverage ratios

The Fed board will hold a rare open meeting on Wednesday to consider proposed revisions to its supplementary leverage ratio, or SLR, standards for large banks. Rep. Mike Flood (R-Neb.) pressed Powell on possible changes to the SLR, particularly if it would exclude Treasurys from the SLR calculation, as it did on a temporary basis during the COVID-19 pandemic.

Powell said he has long supported SLR reform but the Fed proposal will not exclude Treasurys, although the board will ask for public feedback on whether it should.

The COVID-era changes were “an emergency measure,” Powell said. “My long-held view is we should have a permanent measure, and now we’re going to. We have an open board meeting on Wednesday afternoon… and I am very much looking forward to putting this proposal out for comment.”