What is Trade Direction?

Trade Direction helps you define the allowed trading direction: Buy only, Sell only, both, or neither. This is the first filter before the system searches for entry signals.

Simply put:

Market is trending up → Trade Direction allows only Buy → system only displays buy signals

Market is trending down → Trade Direction allows only Sell → system only displays sell signals

Market is sideways → Trade Direction can block all (no trading) or allow depending on your choice

Trade Direction is a shared feature, built into multiple systems: systems using the standard template. Usage is the same regardless of which system you use.

How to enable Trade Direction

Where to find Trade Direction?

Trade Directi is located in the Input Parameters section of the indicator or EA. To open:

Right-click the indicator on chart → select Properties (or press F7)

Switch to Inputs tab

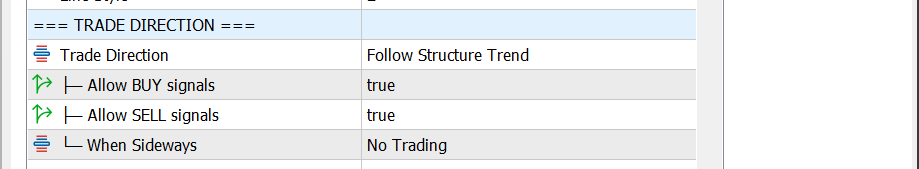

Scroll to the parameter group labeled “Trade Direction” or “═══ DIRECTION FILTER ═══”

How to enable

By default, Trade Direction is in Off state (disabled). To enable:

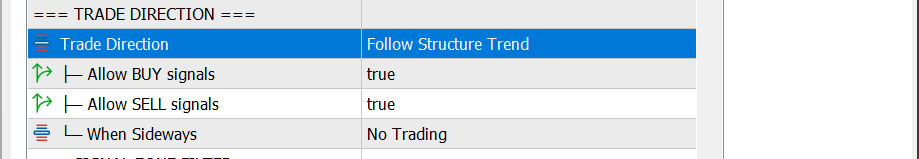

Note: Follow Structure Trend mode requires Market Structure to be running. Market Structure is always enabled by default, so you don’t need to do anything extra.

Input parameters explained

1. Trade Direction — Operating mode

Info Details Name in indicator Trade Direction Default Off (disabled) Values Off / Custom / Follow Structure Trend

Meaning: This is the main switch, determining how Trade Direction operates.

Three modes in detail:

Off (Disabled)

Trade Direction does not interfere with any signals

All Buy and Sell signals are displayed normally

Suitable when you want to evaluate trading direction yourself

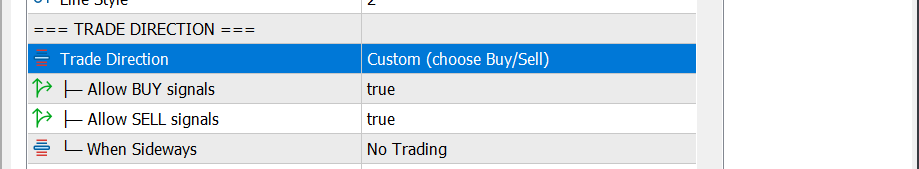

Custom (Manual selection)

You decide which direction to allow using 2 sub-parameters: Allow BUY signals and Allow SELL signals

Example: you believe the market will rise → enable Buy, disable Sell → only see Buy signals on chart

Suitable when you already have your own market direction assessment

Follow Structure Trend (Follow structure trend)

Trade Direction automatically reads data from Market Structure to decide

If Market Structure identifies Uptrend → only allow Buy

If Market Structure identifies Downtrend → only allow Sell

If Ranging (sideways) → depends on When Sideways parameter

Recommended for most users — no need for manual assessment, system analyzes automatically

2. Allow BUY signals — Allow Buy signals

Info Details Name in indicator Allow BUY signals (or ├─ Allow BUY signals) Default true Values true / false Only works when Trade Direction = Custom

Meaning: When in Custom mode, this parameter determines whether to display buy signals.

Note: This parameter has no effect when Trade Direction is in Off or Follow Structure Trend mode.

3. Allow SELL signals — Allow Sell signals

Info Details Name in indicator Allow SELL signals (or ├─ Allow SELL signals) Default true Values true / false Only works when Trade Direction = Custom

Meaning: When in Custom mode, this parameter determines whether to display sell signals.

Combining Allow BUY + Allow SELL:

Allow BUY Allow SELL Result true true Display both Buy and Sell (like filter disabled) true false Display Buy only false true Display Sell only false false No signals displayed (stand aside)

4. When Sideways — Action when market is ranging

Info Details Name in indicator When Sideways (or └─ When Sideways) Default No Trading Values No Trading / Allow Both / Buy Only / Sell Only Only works when Trade Direction = Follow Structure Trend

Meaning: When the system detects a sideways market (Ranging — no clear trend), this parameter decides the action.

When to use which value?

No Trading (recommended): Safest — ranging markets are usually unpredictable, standing aside avoids losses

Allow Both: When you have experience trading in ranges (buy lows, sell highs) and combine with other filters

Buy Only / Sell Only: When you have specific reasons to believe the range will break out in a particular direction

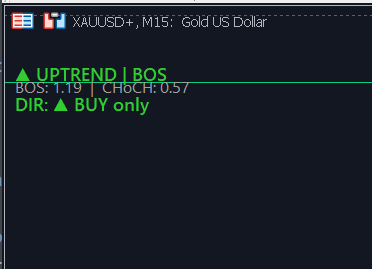

Reading Trade Direction signals on chart

Status Label

When Trade Direction is enabled (Custom or Follow Structure Trend), you’ll see a small text line in the top-left corner of the chart, below the Market Structure label. This line shows which direction the system is allowing.

Displayed statuses

Label on chart Color Meaning DIR: ▲ BUY only Green Buy only allowed — Sell signals hidden DIR: ▼ SELL only Orange/Red Sell only allowed — Buy signals hidden DIR: MANUAL ▏ ▲ BUY + ▼ SELL Yellow Custom mode, both allowed DIR: MANUAL ▏ ▲ BUY only Green Custom mode, Buy only DIR: MANUAL ▏ ▼ SELL only Orange/Red Custom mode, Sell only DIR: MANUAL ▏ BLOCKED Gray Custom mode, both disabled (stand aside) DIR: ◆ RANGING ▏ BLOCKED Gray Auto + ranging market + No Trading DIR: ◆ RANGING ▏ ▲ BUY + ▼ SELL Gray Auto + ranging + Allow Both

Trade Direction is a hidden filter — it doesn’t create additional arrows or lines on the chart. Instead, it blocks or allows pattern signals (Fakey, PinBar, Inverted Hammer…) to be displayed.

Signal in correct direction → displays normally (arrow, zone fill, trading line…)

Signal in opposite direction → disappears completely (not displayed on chart)

Example: Trade Direction shows “DIR: ▲ BUY only” → system detects Fakey Bearish (Sell signal) → this signal is blocked → you don’t see anything on chart.

How to know signal was blocked

Enable Debug Mode in indicator parameters → open MT5 → View → Toolbox → Expert tab. You’ll see logs:

text

[DIR-FILTER] SELL blocked: Structure=UPTREND [DIR-FILTER] BUY blocked: Structure=DOWNTREND

Trading scenarios (examples)

Scenario 1: Follow Structure Trend in Uptrend

You set Trade Direction = Follow Structure Trend, When Sideways = No Trading

Market Structure identifies ▲ UPTREND → label shows “DIR: ▲ BUY only” in green

System detects Buy pattern (Fakey Bullish) → displays on chart ✓

System detects Sell pattern (Fakey Bearish) → blocked, not displayed ✗

You only see Buy signals → trade with the uptrend → safer

Scenario 2: Custom for specific trading session

You analyze that during today’s London session price will fall

Set Trade Direction = Custom, Allow BUY = false, Allow SELL = true

Label shows “DIR: MANUAL | ▼ SELL only” in orange/red

System only displays Sell signals → you focus on sell trades

End of session, change Trade Direction back to Off or Follow Structure Trend

Scenario 3: Ranging — stand aside

Trade Direction = Follow Structure Trend, When Sideways = No Trading

Market Structure shows ◆ RANGING → label “DIR: ◆ RANGING | BLOCKED” gray

System doesn’t display any signals — even if patterns appear

You stand aside waiting for clear trend → when Market Structure switches to Uptrend or Downtrend, signals will reappear

Trade Direction usage tips

Tip 1: Start with Follow Structure Trend + No Trading

This is the safest setting for beginners:

System automatically allows only Buy in Uptrend, Sell in Downtrend, and blocks all when Ranging. You don’t need to assess trend yourself.

Tip 2: Don’t “chase price” when Trade Direction just changed direction

When DIR label changes from “BUY only” to “SELL only” (or vice versa), don’t rush to enter immediately. Wait for:

Direction change is just a “green light” to allow trading — you still need a specific entry signal.

Tip 3: Only use Custom when you have clear reason

Custom mode is suitable when:

You’ve analyzed news/fundamentals and are confident of direction

You’re backtesting only one direction

You want to temporarily “lock” direction during a specific trading session

Avoid: Using Custom then forgetting to change back → missing signals when market changes direction.

Tip 4: Always combine with stop loss and money management

Trade Direction helps filter direction, but doesn’t guarantee every signal will win. Risks still exist:

Trend can reverse right after you enter

Buy signal in Uptrend can still lose if entering wrong price zone

Always set stop loss and don’t risk more than 2–3% of capital per trade

Tip 5: Don’t constantly adjust parameters

Trade Direction has only 4 simple parameters — shouldn’t change constantly during the day:

Choose one mode (recommended: Follow Structure Trend) and keep it

Only change when there’s specific reason (session change, backtesting…)

Avoid “flipping back and forth” between Custom and Auto → causes confusion, misses signals

Tip 6: Accept missing signals

When Trade Direction blocks a direction, you’ll miss some counter-trend signals that could have been profitable. This is an intentional trade-off:

Lose a few small counter-trend opportunities

In exchange: avoid many losing counter-trend trades (usually larger losses than profits)

Long term, direction filtering improves overall results

Tip 7: Prefer H1 timeframe and above when starting

On small timeframes (M1, M5), trend changes fast → Trade Direction “flips” frequently → causes confusion. On H1, H4 and above:

Combining Trade Direction with other features

Trade Direction works most effectively when used with other signal filtering modules in the system. Here are combination methods:

Combination 1: Trade Direction + Market Structure (overall trend)

This is the most natural combination — when you choose Follow Structure Trend mode, Trade Direction automatically reads data from Market Structure.

Tip: Enable Show BOS/CHOCH Lines in Market Structure to see trend change points on chart. When you see CHoCH → prepare for Trade Direction to change direction.

Combination 2: Trade Direction + Signal Zone Filter (structure price zones)

Trade Direction filters direction: Buy only or Sell only

Signal Zone Filter filters position: signal must be near swing zone or BOS/CHoCH event

Result: signal is both correct direction and correct position → highest quality

Example: Uptrend → Trade Direction allows Buy → Signal Zone Filter checks: “Is this Buy near swing HL?” → Yes → display. No → hide.

Combination 3: Trade Direction + Quality Filter / Extreme Zone Filter

Trade Direction filters direction

Quality Filter filters pattern quality (keeps only clear, beautiful patterns)

Extreme Zone Filter filters overbought/oversold zones

Three layers: Correct direction → Beautiful pattern → Reasonable price zone → extremely selective signals

Combination 4: Trade Direction + entry signal (candlestick pattern)

Use Trade Direction as the first filtering step:

Step 1: Which direction does Trade Direction allow? → Buy only

Step 2: Is there a valid candlestick pattern? → Yes (Fakey Bullish)

Step 3: Does that pattern pass other filters? → Yes

Step 4: Enter Buy trade with calculated stop loss and TP

Important: Trade Direction is the “first filter”, other filters are “additional confirmation”. Don’t use in reverse (don’t see beautiful pattern then ignore Trade Direction blocking it).

Combination 5: Choose suitable trading session

Trade Direction is most effective during high liquidity hours:

London session (15:00–23:00 VN time): Forex volatile, clear trends

New York session (20:00–04:00 VN time): Gold and forex volatile

Avoid: Session transition hours (11:00–14:00 VN) — low liquidity, unclear trend, Trade Direction may “flip” back and forth

Optimize by trading style

Quick summary

Frequently Asked Questions (FAQ)

Q: After enabling Trade Direction, all signals disappeared?

A: Possibly market is Ranging + When Sideways = No Trading. Or trend is opposite to common signals on chart. Try changing When Sideways to Allow Both to see if signals appear.

Q: Does Trade Direction draw anything on chart?

A: Yes — a small text line in top-left corner (e.g., “DIR: ▲ BUY only”). Otherwise doesn’t draw additional arrows or lines. Blocked pattern signals simply won’t display.

Q: Does Trade Direction require Market Structure?

A: Only when using Follow Structure Trend mode. Custom and Off modes don’t need Market Structure. Market Structure is always enabled by default, so no need to worry.

Q: Should I use Custom or Follow Structure Trend?

A: Follow Structure Trend for most users — system analyzes automatically, no manual assessment needed. Custom for experienced traders who want to “lock” direction based on their own analysis.

Q: Is Follow Structure Trend delayed?

A: Yes — Trade Direction reacts according to Market Structure, and Market Structure needs a few candles to confirm trend change. This is an intentional trade-off: slower but fewer false signals. If you want faster reaction, decrease CHoCH Confirm Bars in Market Structure section.

Q: I use MTF Dashboard, does Trade Direction apply to signals on other symbols/timeframes?

A: Yes. Trade Direction is applied in both LOCAL (current chart) and MTF (multi-timeframe) pathways. Each symbol/timeframe is evaluated independently.