As a doctor with a competitive edge and an undying interest in personal finance, I couldn’t help but think about one thing when I was becoming financially literate. Who had the better retirement plan offered by their hospital: my wife or I? Wanting to see if my 403(b) at work was better than my wife’s 401(k) and obtain some bragging rights, I set off to write this column. As I compare our retirement accounts, I hope to teach the positives and negatives in your own work retirement accounts, which funds you should invest in if you are just starting on your investing quest, and which funds you should absolutely avoid like Yersinia pestis.

Rikki’s 403(b)

My retirement account at work is a 403(b), which is essentially a 401(k) except the employer is a nonprofit. Unfortunately, this brings up the first ding against my work retirement offering; 403(b) contributions will count toward the $70,000 limit [2025—visit our annual numbers page to get the most up-to-date figures] for my solo 401(k) that I have for my side income. If I had a 401(k) as my work retirement plan, then my solo 401(k) would have a whole new $70,000 to do employER contributions (as I already max out my employEE contributions at my W-2 job). Darnit!

The fee I pay to be part of the plan is a measly $76 per year, which is pretty minimal and definitely a plus for my work plan. The annual fee charged by the average 401(k) servicer, according to the Center for American Progress, is 1% AUM! As I write this, I have about $300,000 in my 403(b), which would have amounted to $3,000 per year. Ouch! My plan does not offer any post-tax contributions or in-plan conversions, which means there’s no capability to do the Mega Backdoor Roth. But hey, plans that have that capability are few and far between.

There is a 403(b) loan option. Taking this option is not financially smart as utilizing it is turning your back on Charlie Munger’s advice when he said, “The first rule of compounding: never interrupt it unnecessarily.” I would argue that having a loan option on your work retirement account is actually a negative since you’d now have a temptation to disrupt your retirement compounding.

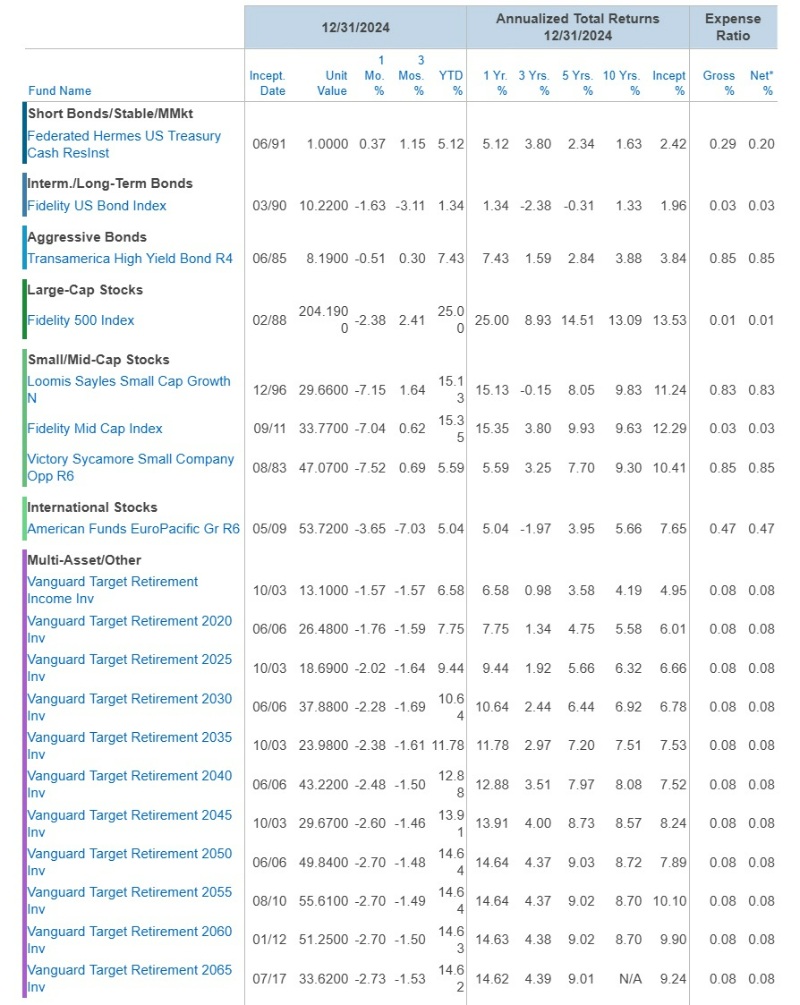

Now, here is what you’ve been waiting for: the investment options:

Expense ratio is the most important predictor of future returns and is the best initial screen for seeing if the funds in your retirement plan are adequate. As Saint Jack Bogle always said, “You get what you DON’T pay for.” Note that we are mostly interested in the “Net” expense ratio, given that this is, in the end, what we as investors are paying. Any expense ratio more than 30 basis points (bps) is something you should definitely consider NOT investing in at all; it’s likely not an index fund, and it will do worse because of higher fees.

Based on the all-important expense ratio, this lineup looks good with multiple low-cost options. The first listing is basically cash; it’s officially a money market fund similar to what you would find as the cash option at your brokerage company. The 20 bps expense ratio is a little high compared to the Vanguard money market fund, which is 11bps, but it’s not a big deal. The bond fund offered is an excellent total bond fund with a cost of only 3 bps. You can’t get an expense ratio lower than that for a total bond fund. Then, there is an S&P 500 index in there called the Fidelity 500 with an ER of only 1 bp. AWESOME! There’s also a mid-cap index that is only 3 bps. Finally, there are the Vanguard Target Date Funds, which have the ERs of only 8bps, the lowest cost TDFs in the business (but not without controversy).

Unfortunately, the other funds in my plan are . . . (sorry, about to vomit in my mouth) . . . actively managed. I can easily tell just by looking at the high ERs that the actively managed funds are Transamerica High Yield, Loomis Sayles Small Cap Growth, and Victory Sycamore Small Company Opp funds. These funds are way over my 30 bps ER recommendation when choosing a fund in your retirement account. I would bet my kids’ lives that, in the long run, investors in those funds would lose money compared to investing in the cheaper passive funds within this retirement account. I am ashamed that my hospital has a retirement plan with these crappy funds. If you have high-fee actively managed funds in your retirement account, stay away.

A little digression for my advice on not choosing funds with an ER greater than 30 bps. Obviously, this is only a superficial rule of thumb, and a more financially literate person could make cogent arguments to maybe invest in higher ER funds. But if you are just starting out investing, this rule takes advantage of System 1 thinking: to overcome the analysis paralysis bias (a System 1 bias), this rule will help you choose funds that, over the long run, will most likely do well just because of their low cost. Fight fire with fire, especially when it comes to behavioral biases.

OK, digression over: now to my wife’s plan.

More information here:

Saving for Your Future Stranger

Yes, Risk Tolerance Can Be Modified: You Just Have to Rewire Your Brain

My Wife’s 401(k) and NQDC Plan

My wife’s retirement plan is a 401(k), which would have been much more advantageous combining it with my solo 401k as mentioned above (she doesn’t have one). There is a Roth option and a 401(k) loan ability, similar to mine. There is no ability to do a Mega Backdoor Roth. My wife does have an option to contribute to a “non-qualified deferred compensation plan” (NQDC). You might have something similar. This plan is basically like a non-governmental 457(b) that for-profit institutions can offer with some caveats. The rules are under Internal Revenue Code 409(a). There are no contribution limits to this type of plan, unlike 457bs, where there are caps similar to a 401(k). Also, employer contributions to the NQDC plan have a vesting schedule. In my wife’s case, her hospital was contributing $20,000 a year, and she was not fully vested in that money for five years. This serves as golden handcuffs where she was incentivized to stay at least five years to have that full $100,000 in the plan. This is quite different from a 457(b), where employer contributions are immediately 100% vested. Similar to a 457(b), the NQDC is subject to the employer’s creditors. Also, if she leaves her job, she has distribution options to take a lump sum or to take it out over five, 10, or 15 years—similar to what a 457(b) would offer.

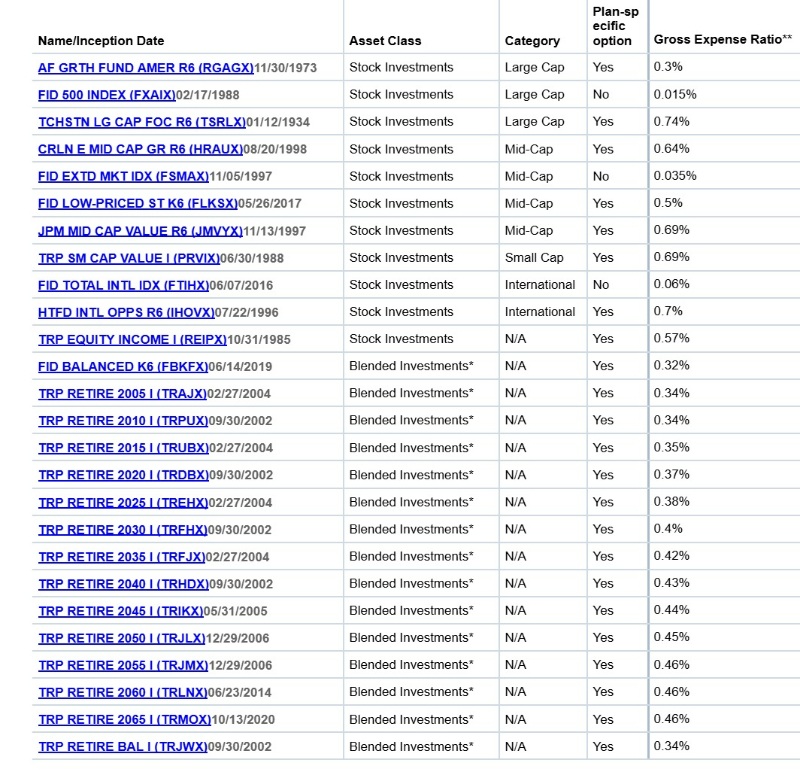

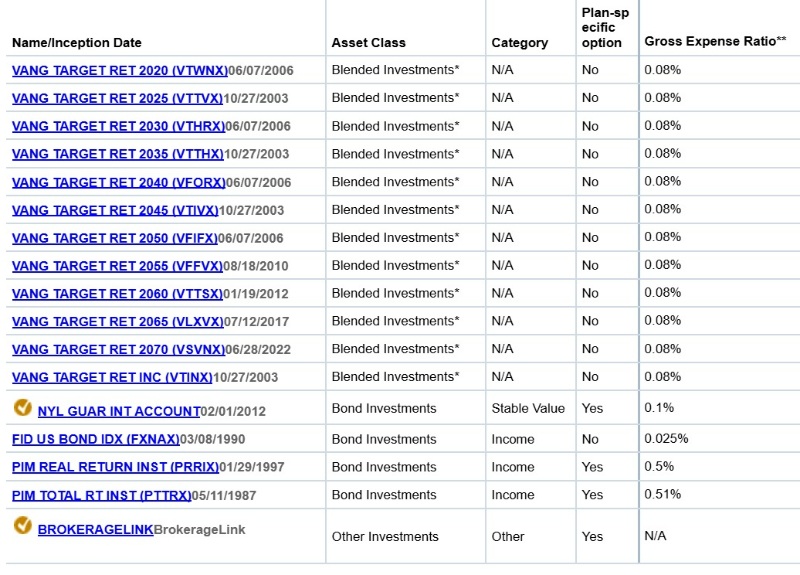

My wife’s servicer of the 401(k) plan is Fidelity, a highly reputable brokerage firm known to undercut even Vanguard’s low ER index funds. I failed to mention previously that my retirement plan servicer is Transamerica, which is not known as one of the good guys in the industry in terms of low-fee funds. I had assumed that there might be more lower-cost index fund options in my wife’s 401(k). Let’s take a look at her investment options:

Unfortunately, there seem to be more options in my wife’s plan that violate my 30 bps or more rule, where the fund probably sucks due to its higher expense ratio and is highly likely to underperform because of its stupid high fees and because it’s actively managed. Also, there are over 40 options from which to choose. I mentioned analysis paralysis previously, and with more options, the more dangerous analysis paralysis becomes.

A quick tangent: there was a famous jam grocery store experiment that really punched home the idea of analysis paralysis to researchers. The experimenters, Sheena Iyengar and Mark Lepper, displayed only six options of jam one day at a local grocery store, and then on another day, they displayed 24 options of jam. Which day sold more jam? At first blush, you would think the day that had 24 options of jam would beat the pants off the six-jam option day. Come on, 24 options! That’s 4x more chance that a jam would perfectly fit the taste buds of your average grocery shopper’s palette. In reality, jam sales tanked on the 24-option day vs. the six-option jam day. Why? Analysis paralysis.

Which brings me to the next point regarding Target Date Funds. The TDFs are also designed to eliminate analysis paralysis by being like the EASY button. You just look up the year you are going to retire, pick that fund, and the TDF does the rest by dynamically lowering equities and increasing bonds as you approach retirement. What a great option for those who just want a simple solution and to move on with life. But with my personal interest in finance and extremely high risk tolerances, we chose an asset allocation of 100% equities (in all honesty, I chose the 100% equity asset allocation, and my wife chooses not to remember the password to our accounts so she can’t even look, giving her the highest risk tolerance among us!).

I choose to go through all those options of jam in my retirement account, whereas a TDF makes the jam-picking easy for those who just can’t be bothered.

So far in this analysis, I’m winning.

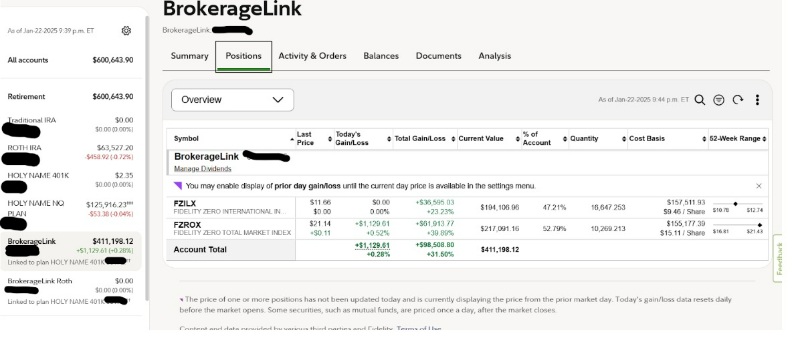

But wait, did you see that last option listed called “BrokerageLink?” This is what makes my wife’s 401(k) AWESOME (and makes me the eventual loser in this fight). The menu of options offered in this 401(k) is moot given the BrokerageLink option, which allows you to invest in whatever low-cost index funds you want—similar to what you can invest in a taxable brokerage account. I definitely do not have this option in my 403(b).

More information here:

Beware! An HSA Is Great But . . .

How I Failed and Then Mastered the Backdoor Roth IRA

My Wife Wins Again

For those who personally know us, my wife obviously wins in the superior human being category. In terms of a superior retirement plan, she also wins. Despite having more crappy (that’s an official financial term!) high-fee actively managed funds, more expensive TDFs, and over 40 investment options (making analysis paralysis a larger and more formidable investing barrier), this is all overcome by the BrokerageLink. The BrokerageLink is sooooo key and is what essentially makes all those bad funds moot. Which brings me to an important point: please see if your work retirement account has a brokerage window like my wife’s! It is such a phenomenal option where you can now invest in the lowest fee funds out there.

In the end, though, we are married. So, with that BrokerageLink, we both win. Our asset allocation is 50% total US, 25% total international, and 25% small cap value. I have discussed previously that I usually stick to ETFs in taxable and keep either VTI or ITOT for total US, and IXUS or VXUS for total international ex-US, depending on tax-loss harvesting. In our Roth IRAs, the small cap value allocation already fills up our Roth space (as asset location dictates putting your highest growth assets in Roth), and we still have more small cap value in which to invest. I am also running out of space in my solo 401(k).

Where do we turn? My wife’s BrokerageLink! Our preferred fund for small cap value is VBR, which we can access in the BrokerageLink. Otherwise, the only other option would have been doing VBR in taxable, which is not as tax-efficient. Also, I don’t have a good total international fund in my 403(b), so we have FZILX (the Fidelity Zero Total International Fund) in her BrokerageLink. Finally, we round out the rest of our asset allocation—the remaining total US—with the Fidelity 500 and Fidelity mid-cap in my 403(b) and FZRX (the Fidelity Zero Total US) in her BrokerageLink. Voila, perfect asset location!

Finally, guess what happens during rebalancing time? If we can’t rebalance easily with additional contributions, we can just buy or sell into my wife’s BrokerageLink without tax consequences.

As per the Department of Labor, 401(k) and 403(b) plans are supposed to be fiduciaries that “run the plan solely in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits and paying plan expenses. Fiduciaries must act prudently and must diversify the plan’s investments in order to minimize the risk of large losses.” Notice the government never use the words “best” or “optimized,” opening the door for your retirement plans to have painfully high-fee funds in them.

Overall, retirement plans are an awesome retirement vehicle for an overtaxed high-income professional, but you have to avoid the booby traps that might lie within them.

What do you think? Do you have a good retirement plan? Why or why not?